Obamacare 101: What owners of small businesses need to know

Loading...

| Washington

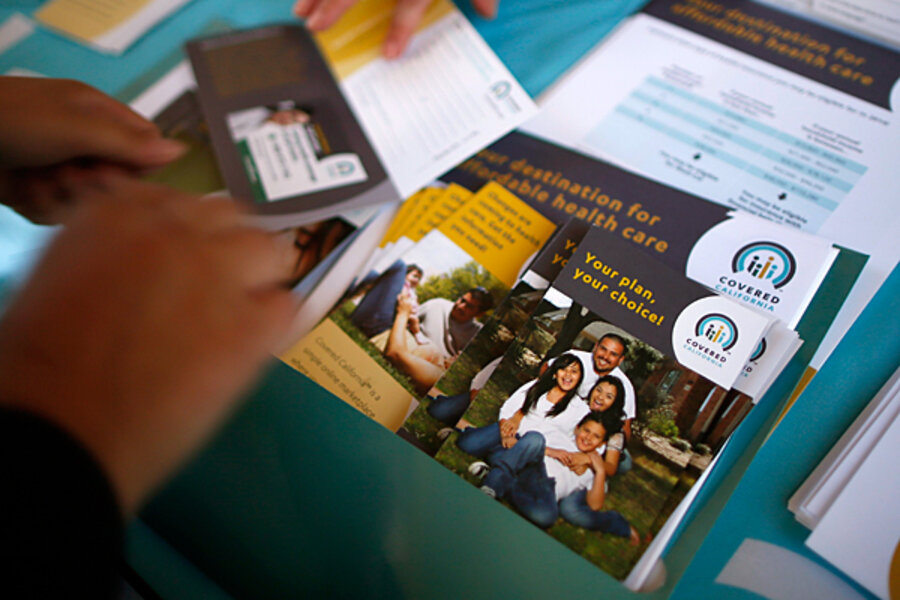

Oct. 1 marked the start of a separate online health-insurance marketplace for small business owners, known as the Small Business Health Options Program, or SHOP.

SHOP is designed to help owners of small businesses – those with fewer than 50 full-time-equivalent employees – provide health insurance for their employees in a cost-effective way. Business owners who enroll may qualify for a health-care tax credit worth up to 50 percent of the cost of premiums.

As with online exchanges for individuals, the SHOP exchanges – one for each state and the District of Columbia – can be accessed via HealthCare.gov. The site will direct you to your state’s exchange.

If your state is running its own exchange, you can already enroll online. If your state opted for a federally run exchange, online enrollment starts Nov. 1. In all states, you can enroll over the phone, in person, or via a paper application sent in the mail. Coverage begins on Jan. 1, 2014.

Here are some questions and answers about SHOP:

Why can’t a small business owner just send his or her employees to the exchange for individuals and families?

That’s certainly an option, but as with large businesses, small businesses can attract good employees by offering health coverage. The purpose of SHOP is to provide small business owners with a cheap source of insurance.

Will the plans on SHOP actually be cheaper than in the open market?

In theory, the SHOP exchanges will offer small employers greater purchasing power and lower-cost insurance, because they can pool their risk. But news reports indicate that most of the small business exchanges aren’t offering a choice of plans in 2014. Also, Politico notes, it’s harder for small businesses to follow all the new rules than it is for large businesses, since they don’t have big human resources departments.

Where can small business owners go for guidance on SHOP?

The Small Business Administration (SBA) and the advocacy group Small Business Majority are conducting weekly webinars for small business owners to learn the basics of the Affordable Care Act and SHOP. Visit SBA.gov/healthcare for details. A toll-free number is also available for questions on SHOP: 800-706-7893.

Are there special provisions for companies with fewer than 25 employees?

Yes, in 2014 the health-care tax credit for companies with fewer than 25 employees will increase from 35 percent to 50 percent, as long as the company participates in SHOP.

The small business health-care tax credit is targeted at companies with low- and moderate-income workers. Businesses with fewer than 25 full-time-equivalent employees that pay average wages below $50,000 a year, and contribute toward at least half of employees’ health-insurance premiums, qualify for the tax credit. IRS.gov provides information on how to calculate full-time-equivalent employees and average annual wages.

The Internal Revenue Service also provides a Small Business Health Care Credit Estimator to help small companies find out if they’re eligible for the tax credit.

Other articles in the Monitor's Obamacare 101 series:

• What happens starting Oct. 1?

• What to know if you already have health insurance

• How the federal subsidy works

• What to know if you opt out of buying health insurance

• When will the enrollment glitches be fixed?

• What college students need to know

• Seven ways you can sign up, despite Web woes

• Enroll by March 31 to avoid penalty, White House clarifies