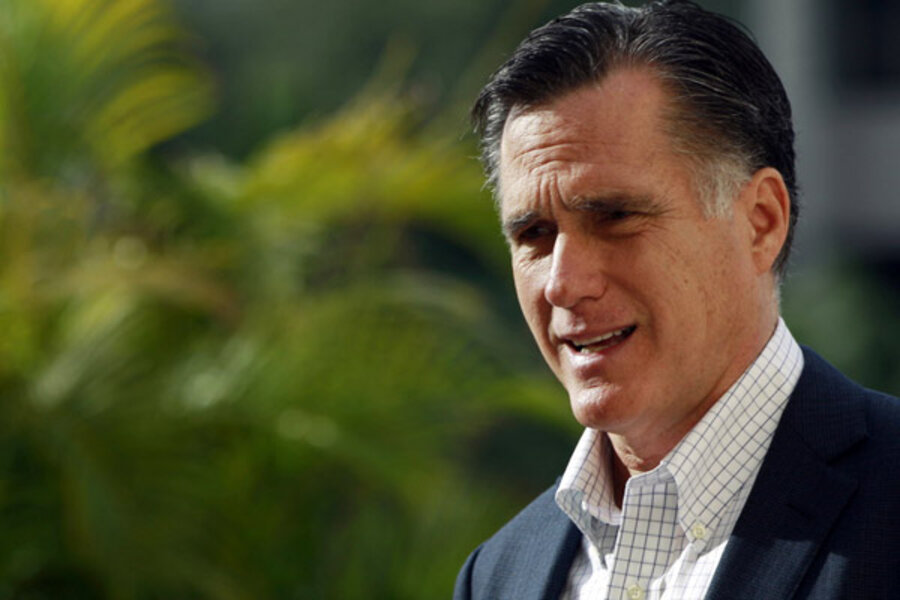

Romney paid about 14 percent income tax in 2010

Loading...

| WASHINGTON

Republican presidential candidate Mitt Romney paid about $3 million in federal income taxes in 2010, having earned more than seven times that — $21.7 million — from his investments and making him among the wealthiest of American taxpayers.

At the same time, Romney gave nearly $3 million to charity — about half of that amount to the Mormon Church — which helped lower his effective tax rate to a modest 14 percent, according to records his campaign released early Tuesday.

For 2011, he'll pay about $3.2 million with an effective tax rate of about 15.4 percent, the campaign said. Those returns haven't yet been filed yet with the Internal Revenue Service.

The former Massachusetts governor had been under pressure in recent weeks to release his tax returns, his GOP opponents casting him as a wealthy businessman who slashed jobs in the private sector. Rival Newt Gingrich made public his returns on Saturday, showing he paid almost $1 million in income taxes — a tax rate of about 31 percent.

Romney's campaign confirmed the details of his tax information after several news organizations saw a preview of the documents. He had said planned to release his returns in full Tuesday morning, and campaign officials would be prepared to discuss them in detail with reporters.

"You'll see my income, how much taxes I've paid, how much I've paid to charity," Romney said during Monday night's debate in Tampa. "I pay all the taxes that are legally required and not a dollar more. I don't think you want someone as the candidate for president who pays more taxes than he owes."

Romney's 2010 returns show the candidate is among the top 1 percent of taxpayers. The returns showed about $4.5 million in itemized deductions, including $1.5 million to the Church of Jesus Christ of Latter-Day Saints.

Before the tax records were released, Romney's old investments in two controversial government-backed housing lenders stirred up new questions at the same time his campaign targeted Gingrich for his work for Freddie Mac.

Gingrich earned $1.6 million in consulting fees from Freddie Mac even though Romney has as much as $500,000 invested in the U.S.-backed lender and its sister entity, Fannie Mae.

The dimensions and the sources of Romney's wealth, which he has estimated to be as much as $250 million, have become pivotal issues in the roiling GOP primary campaign. For months, Romney dismissed calls to release his personal income tax records. But after mounting criticism from his rivals and others, coupled with his stinging weekend loss to Gingrich in the South Carolina primary, Romney agreed to release his 2010 return and 2011 estimate.

Romney already has acknowledged that his current tax rate is about 15 percent, a level far lower than standard rates for high-income earners and similar to the capital gains rate. "I'm proud of the fact that I pay a lot of taxes," Romney said.

The current lowest rate for long-term capital gains is 15 percent, but a higher rate of 20 percent had been in effect since 1981 until President George W. Bush signed into law a massive tax cut program in 2001.

Romney's vast investments contain other funds than the ones he profited from as a Bain Capital executive. But it was unclear whether he had any direct role in handling the investments in Fannie Mae and Freddie Mac that appear on his 2012 presidential disclosure.

One investment, listed as a "Federated Government Obligation Fund" and worth between $250,000 and $500,000, was a mutual fund that included both Fannie Mae and Freddie Mac assets among a larger pool that included other government securities.

The holding was not listed in Romney's blind trust, which led some Democratic Party activists to suggest that the investment was under his direct control.

"He is relentlessly attacking Newt Gingrich over his ties to Freddie Mac despite the fact that he personally invested up to a half a million dollars in both Fannie Mae and Freddie Mac," said Ty Matsdorf, a senior adviser with American Bridge 21st Century, a PAC associated with Democratic Party and liberal causes.

Former GOP Rep. J.C. Watts, a Gingrich supporter, said Monday that Romney was on a slippery slope calling his opponent a lobbyist and raising doubts about Gingrich's work for Freddie Mac. But he did not directly address Romney's investments with the lender or with Fannie Mae.

"Some might see it as splitting hairs. But Newt Gingrich was not walking the halls of House and Senate," Watts said on a conference call arranged by the campaign. "He was never doing the hand-to-hand combat doing the lobbying, consulting, whatever you want to call it."

A Romney campaign official who insisted on anonymity to discuss that investment in greater detail said that Romney's trustee had bought the government investment fund in 2007, before the housing crisis broke.

The Romney official said that the government fund was purchased through a charity trust that does not appear in Romney's presidential disclosure but will show up on his income tax return for 2010. That trust, called a Charitable Remainder Unitrust, is a standard tax strategy among the wealthy that provides investors with a fixed payout each year. What remains in the account at a later date, or when the investor dies, is turned over to charity, the official said.

Romney does not directly control the investment account, Romney campaign senior adviser Eric Fehrnstrom said earlier on Monday. "His investments are controlled by a trustee," Fehrnstrom said.

Separately, Romney's IRA retirement account lists both a Fannie Mae and a Freddie Mac security, each worth between $100,000 and $250,000. But because those are in Romney's IRA, they also appear to be under control of the trustee.

Tax experts said Romney's income tax returns may contain other charity structures and tax strategies designed to both boost his income and charity donations, while minimizing his involvement because of his presidential ambitions.