Why won't Mitt Romney make his tax returns public?

Loading...

| Washington

Welcome to the rumble in the tax return jungle.

Rick Perry wants Mitt Romney to cough up his form 1040s (that’s the US individual tax return document). The Romney camp demurred, saying they would consider doing so next year. (Remarkably, Romney has NEVER released, even during his governorship of Massachusetts.)

Why won’t Romney do it? Speculation, from liberal group ThinkProgress and others, is that Romney pays a way lower tax rate than many Americans because of his extensive financial investments, from which income is typically taxed below that of regular income. One left-leaning analyst speculates Romney paid an effective tax rate as low as 14 percent on his $6.6 million to $40 million in income. (The range is so wide because of the imprecise nature of Romney’s very limited disclosures.)

To put that in perspective: In 2011, a married couple filing together would have to make under $69,000 to have their top tax rate be 15 percent. Uber-rich Warren Buffett says he pays 17 percent in taxes.

One point in Romney’s favor: The average federal income tax rate for all Americans was 11.06 percent in 2009. Nearly half of Americans pay no federal income tax, a point that hasn’t gone unmentioned in GOP presidential debates.

Why is this brouhaha important? As Decoder wrote earlier this week, Democrats and Republicans alike could be trying to “Gore” (as in Al) Mitt Romney as wooden, politically inconsistent and out-of-touch with ordinary Americans. Paying a lower share of your income taxes than most if not all of your competitors for the presidency and a number of middle class Americans would help those attack lines along.

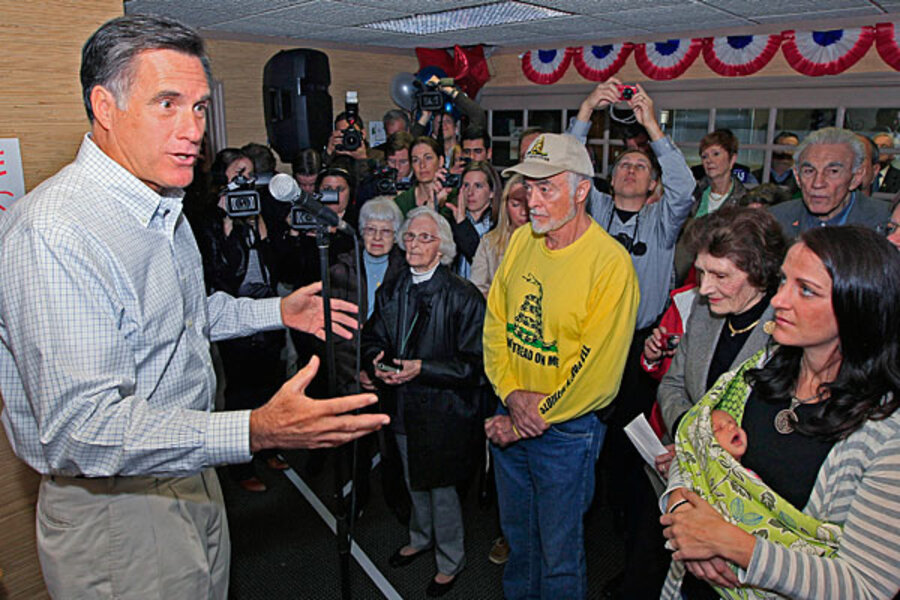

Moreover, if predictions about Mitt Romney’s tax situation are true, he would have to go in front of ordinary Americans at every debate, town hall and rope line saying he was looking out for their interests while paying a vastly lower percentage in taxes on his substantial wealth in taxes. [Editor's note: The original post omitted "percentage of taxes."]

Perry - who paid 23.4 percent of his 2010 income of a bit north of $200,000 to the federal government - is no doubt hoping Romney’s tax return would write the attack lines for him.

Want to dig deeper?

- Check out all presidential and (and some vice presidential) tax returns back to Richard Nixon at TaxHistory.org.

- Sign a petition from liberal group Priorities USA for the repeal of the “Romney Rule,” which they describe as having corporations and the rich pay less in taxes than the middle class.

- Want to “Scrap the Code”? Sign the petition from tea party group FreedomWorks arguing for a “simple, low, fair and honest” tax code.

Like your politics unscrambled? Check out DCDecoder.com.