Smart tax reform could shrink the government.

Loading...

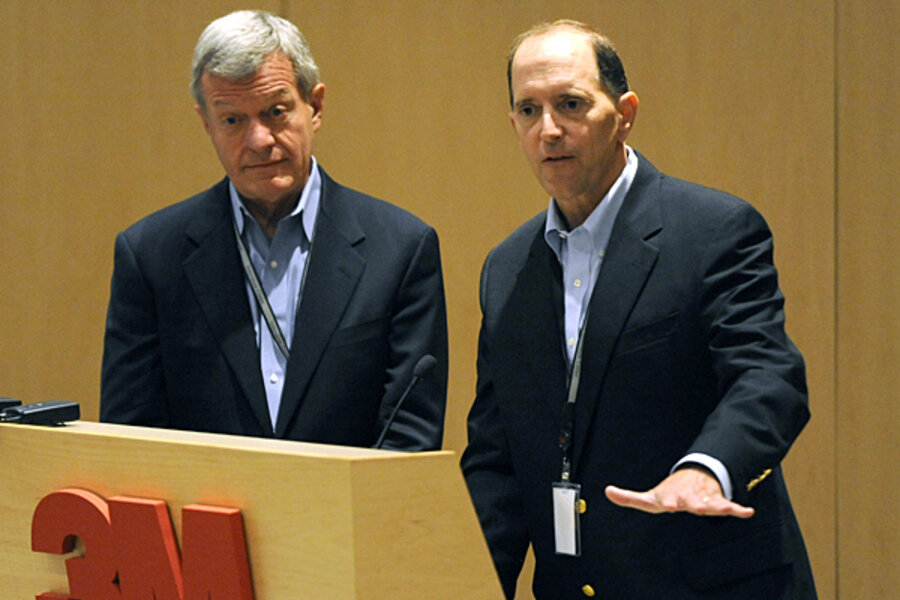

Max Baucus and Dave Camp, leaders of the Senate and House tax-writing committees, are on the road promoting tax simplification. One goal: cleaning out the mess of deductions, exclusions, credits, and other tax breaks that complicate the code.

Done well, such house cleaning could make for a simpler, fairer, more pro-growth tax code. It could also shrink government’s role in the economy. Eric Toder and I explore that theme in a recently released paper, Tax Policy and the Size of Government. Here’s our intro:

How big a role the government should play in the economy is always a central issue in political debates. But measuring the size of government is not simple. People often use shorthand measures, such as the ratio of spending to gross domestic product (GDP) or of tax revenues to GDP. But those measures leave out important aspects of government action. For example, they do not capture the ways governments use deductions, credits, and other tax preferences to make transfers and influence resource use.

We argue that many tax preferences are effectively spending through the tax system. As a result, traditional measures of government size understate both spending and revenues. We then present data on trends in U.S. federal spending and revenues, using both traditional budget measures and measures that reclassify “spending-like tax preferences” as spending rather than reduced revenue. We find that the Tax Reform Act of 1986 reduced the government’s size significantly, but only temporarily. Spending-like tax preferences subsequently expanded and are now larger, relative to the economy, than they were before tax reform.

We conclude by examining how various tax and spending changes would affect different measures of government size. Reductions in spending-like tax preferences are tax increases in traditional budget accounting but are spending reductions in our expanded measure. Increasing marginal tax rates, in contrast, raises both taxes and spending in our expanded measure. Some tax increases thus reduce the size of government, while others increase it.

Eric and I first presented this line of reasoning in How Big is the Federal Government? in March 2012. Our latest paper, recently published in the conference proceedings of the National Tax Association, is a pithier presentation of those ideas.