The Fed's new plan: Will buying mortgage bonds create jobs?

Loading...

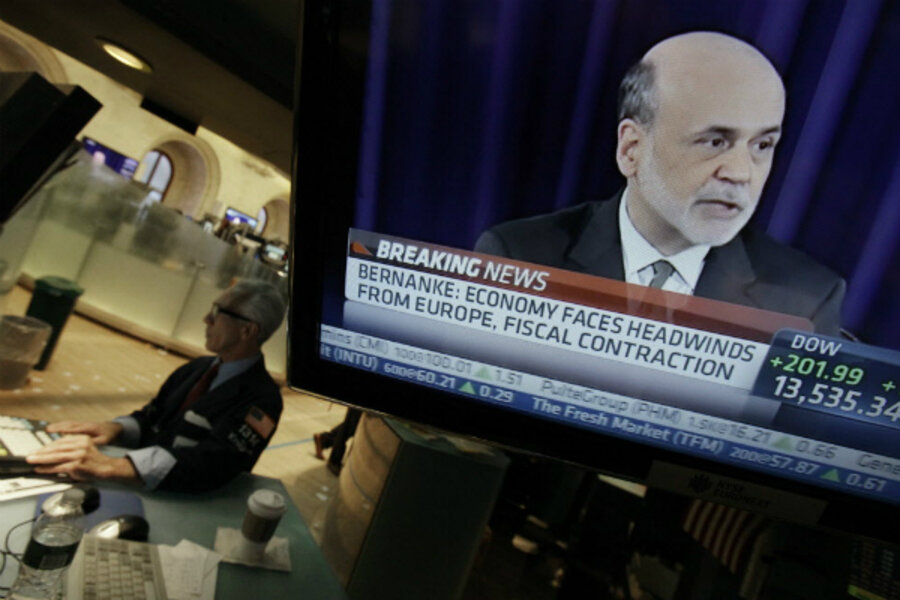

The Federal Reserve launched a new effort to rev up economic growth Thursday, and framed the policy with a bold statement of conditionality: The Fed said it will buy a large volume of mortgage securities every month until the job market shows substantial improvement.

"If the outlook for the labor market does not improve substantially," the Fed's policy committee said, then the program of buying mortgage bonds at a pace of $40 billion per month will continue or be expanded.

The Fed also said it expects to keep short-term interest rates at "exceptionally low" levels through at least the middle of 2015. That's a year later than what the Fed had been espousing.

The new policy effort comes after months in which the US economy has showed only tepid growth, and the unemployment rate has remained at 8 percent or higher.

"The idea is to quicken the recovery," Fed Chairman Ben Bernanke said in a press conference Thursday afternoon. "What we need to see is more progress [on jobs].... What we've seen in the last six months isn't it."

The Fed action also comes at an unusual moment: less than two months before a close presidential election, in which the health of the economy is the central issue. Bernanke defended the central bank against accusations in some quarters that its actions may amount to meddling in politics.

"We make our decisions based entirely on the state of the economy, and the needs of the economy," Bernanke said.

To many people, the more vital question about the Fed actions is, will they work?

Although the details of the move weren't known in advance, their general thrust was anticipated. This represents a third round of so-called "quantitative easing," or QE3, after two rounds that got mixed reviews. The QE name comes from the notion that, with interest rates near zero, one of the few tools remaining for the Fed is to expand the quantity of assets on its balance sheet.

The idea behind buying bonds, and specifically focusing on mortgage bonds, is that this "should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative" to economic growth, the Fed statement said.

"Overall, the Fed has done all the markets were asking for," economist Paul Ashworth of Capital Economics said in an analysis of the Fed action. "The problem is that we doubt it will be enough to get the economy on the right track. It's only a matter of time before speculation begins as to when the Fed will raise its purchases from $40 billion a month."

Some economists say QE may do more to boost inflation than to generate job creation.

"Evidence from the Fed’s prior quantitative easing efforts suggests that the added liquidity supplied to the financial system is largely flowing into commodities and financial assets," Russell Price, a senior economist at Ameriprise Financial, said in a commentary Thursday.

Stock prices in the US rose by about 1.5 percent for the day, while oil prices rose about 1 percent for the day. Gold, seen by many investors as a hedge against inflation risks, rose nearly 2 percent.

Bernanke said that if the move pushes up asset prices, including for houses and stocks, that will help to generate more consumer spending and confidence. That, in turn, will affect business hiring. He also said consumer price inflation has remained near the Fed's target of 2 percent a year, and that the Fed is prepared to respond if inflation pressures emerge.

Bernanke was also questioned by reporters about the communications shift in making this week's policy action conditional on labor-market outcomes.

"Our policies have always been conditional" to some degree, Bernanke said, in a reference to the Fed's frequent pledges to adjust its policy to economic realities. But he added: "The idea here is to make that more explicit," and to make it "more obvious that the Fed will do what's need to provide support for the economy."

Before taking questions, the Fed chairman chose to address a prominent concern of Fed critics – that current interest-rate policies are hurting savers. Many Americans watch their money lose ground to inflation when they earn low interest in a money-market or savings account.

Bernanke acknowledged the problem, but said that low interest rates cut a different way as well, boosting the value of homes and financial assets. If that makes people wealthier and, more important, helps the economy recover, then the average household is better off for the Fed's policy, he said.

"It's hard to save without income from a job," he added.