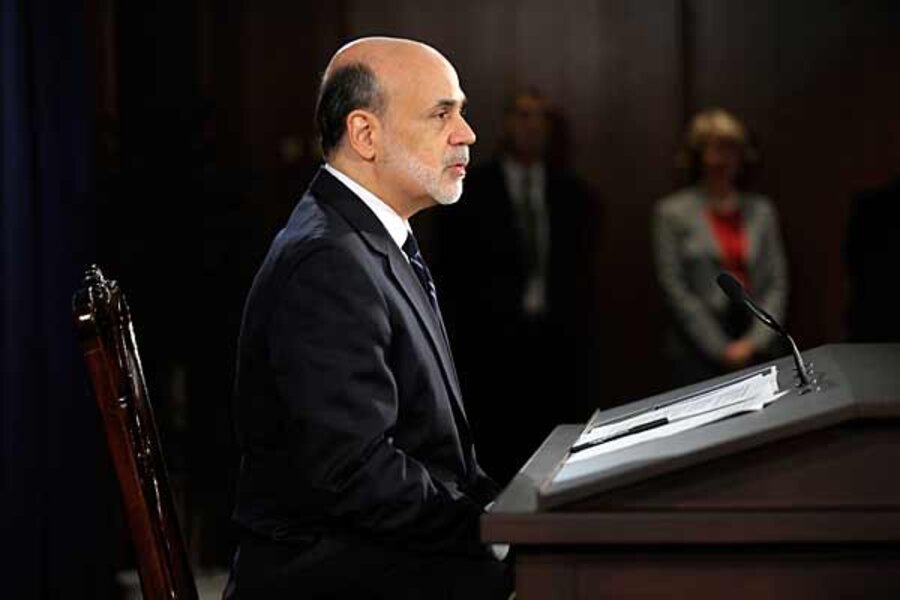

'Fiscal cliff' threatens economy on Dec. 31, Bernanke warns Congress

Loading...

Ben Bernanke has often talked about the need for sounder budget policies in Washington, but the Federal Reserve chairman has ramped his message up a notch: Failure to take new action by the end of year, he said, would have negative effects on the economy that even the Fed couldn't offset.

The reason for his urgency is what some economic analysts call a "fiscal cliff" that awaits America on Dec. 31. Others call it "Taxmageddon."

At year-end, a range of tax cuts are currently set to expire, potentially dampening consumer spending as households are forced to send more of their income to the US Treasury.

The Federal Reserve chief was asked about the implications in a press conference Wednesday afternoon, following a scheduled meeting of the Fed's policy committee. Specifically, if no action occurs before a new Congress convenes early in 2013, would the Fed try to act to offset the impact?

"We'll have to take fiscal policy into account to some extent," Mr. Bernanke said, "but I think it's very important to say that if no action were to be taken by the fiscal authorities, the size of the fiscal cliff is such that there's I think absolutely no chance that the Federal Reserve could or would have any ability whatsoever to offset that effect on the economy."

The conservative Heritage Foundation has estimated the size of the tax shift at $494 billion in 2013, or about 3 percent of the economy's total output.

Among the expiring breaks are Bush-era tax rates on personal income, capital gains, and dividends; a payroll-tax reduction; and some tax relief for businesses. The foundation says tax changes related to President Obama's health-care reform law are also set to kick in, drawing more revenue from taxpayers.

Meanwhile, some scheduled spending cuts could reduce the role of the federal government as a consumer in the economy. And the longer-term challenge is that chronic budget deficits keep adding to America's public debt.

Bernanke implied that fiscal inaction could have effects that are hard for the Fed to resolve. In part, that's because global investors could lose faith that the US government can get its deficits under control.

"As I've said many times before, it's imperative for Congress to give us a fiscal policy that achieves two principal objectives. The first is, of course, to achieve fiscal sustainability over the longer term. That is critical," Bernanke said.

The second objective, he said, is to set that new course without doing short-term damage to the economy.

"I have concern that if all the tax increases and spending cuts that are associated with the current law ... occur on Jan. 1, that that would be a significant risk to the recovery," Bernanke said. "So I'm looking and hoping that Congress will take actions that will address both sides of that – both requirements of a good fiscal policy."

Amid the alarm bells, it's important to take Bernanke's remarks in context.

The Fed has considerable power to influence the economy, by pumping fresh money into the banking system, but it faces some practical constraints.

The central bank's policy committee has already lowered short-term interest rates nearly to zero, and it's ballooned its balance sheet by buying up assets like mortgage securities, in an effort to nudge the economy into healthier growth. If it tries to do much more, one risk is that inflation could heat up.

Moreover, federal budget policy, an important part of the economy, is outside the Fed's control. So leaning on politicians to act is an obvious step for Bernanke to take.

If politicians don't act, the Fed could always try another round of "quantitative easing" – buying financial assets like bonds in an effort to boost economic optimism and expand the flow of bank credit.

But Bernanke would rather not have to respond to a man-made emergency. And he has genuine concern about what gridlock in Congress might mean for the economy. Printing more money, for example, can't by itself restore shaken confidence in the US dollar.

It's not clear when investor confidence in US Treasury bonds might weaken. But many economists say that, without reforms to put the United States on a more sustainable fiscal course, it's only a matter of time before concerns about sovereign debt levels flare in America as they have in Europe.

That time may not be far away, says Paul Kasriel, chief economist at Northern Trust in Chicago.

"My suspicion is that by 2014, if we ... have not put forth a credible program to rein in future entitlement spending and raise revenues, then I think the markets are going to start to turn against us," he said in an interview last month.