As Ireland votes on EU treaty, many ask if it's worth cost of membership

Loading...

| Dublin

Standing in his field outside the village of Redcross in mid-May, an hour south of capital city Dublin, farmer David Johnson is clearly enjoying the unusually warm, dry weather that is allowing him to literally make hay.

"You still get a quality of life. Even when things aren't going right," says the County Wicklow beef farmer.

But despite tourist images of Irish pastoral bucolia, quality of life isn't the reason farms exist. They are businesses, and in Ireland, the European Union is central to the industry. Agri-food is one of the few success stories in post-crash Ireland, worth 9 billion euros ($11.2 billion), with 83 percent of the sector's exports going to EU countries.

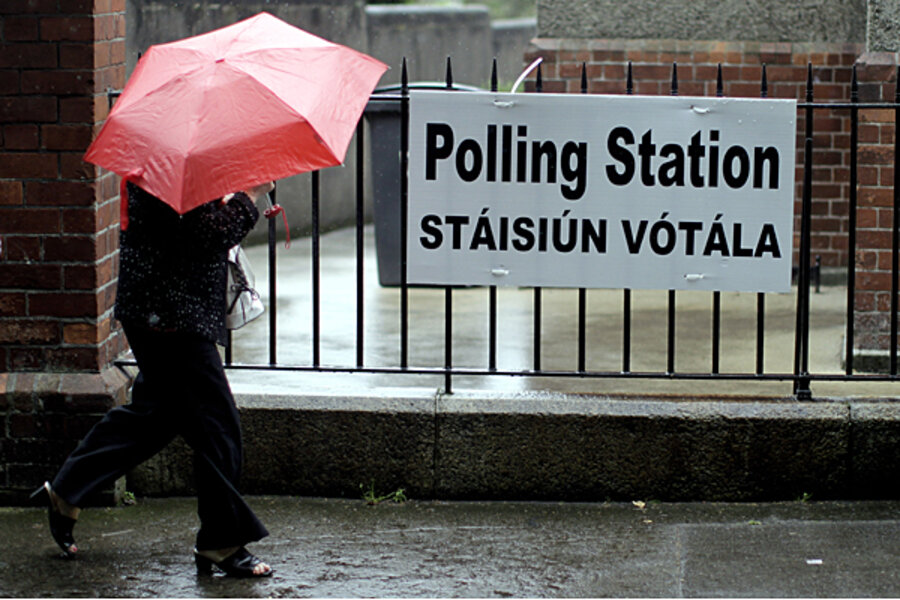

As Ireland goes to the polls today in a referendum on the European Unity fiscal unity treaty, much of the vote will be driven by voters' assessment of how much they benefit from the full support of the EU, and whether those benefits outweigh the costs of austerity.

"I'm probably going to be voting yes. As farmers we are, more than most, committed to the European Union," says Mr. Johnson.

The European Fiscal Compact creates a 780 billion euro ($967.5 billion) permanent bailout fund called the European Stability Mechanism (ESM) for member countries to draw on in return for running a structural deficit of no more than 0.5 percent. If a country breaks the rules, it will be subject to penalties issued by the European Court of Justice.

But the low deficit threshold makes desperately needed government stimulus difficult to implement. If Ireland signs on to the treaty, it is rejecting growth driven by government spending.

Ben Tonra, professor of international relations at University College Dublin, says he is a committed pro-European, but a "yes" vote can be made through gritted teeth at best. "I think it's a bad treaty in terms of politics and in terms of economics, but it's the only way," he says.

The German-led plan does not need Irish endorsement. As a so-called "intergovernmental treaty," only 12 of the 17 nations that use the euro currency must sign for it to pass into law. But a "no" from Ireland would be a slap in the face to Europe and, the government claims, would lock Ireland out of any future bailout funding.

The Irish government says the treaty will create certainty in the markets, allowing investment to flow back into Ireland. Speaking yesterday, Prime Minister Enda Kenny said a "yes" vote would spur recovery by "send[ing] out the message that Ireland is on the road to recovery, that we are a place of economic and budgetary stability."

Despite efforts at recovery, endless bad news

Once the golden boy of Europe, Ireland's then-rapidly growing economy earned it the nickname of "Celtic Tiger."

But the economy crashed in 2008. Ireland responded with the textbook austerity prescription: tax hikes and savage cuts in public spending, all made with the promise that things would get better. But for many Irish, they haven't, fueling concerns that a longterm slump has set in.

Exports are booming, both in foreign direct investment sectors such as software and pharmaceuticals and in the native agricultural food industry, but the domestic economy has flat-lined. Real estate prices have dropped by 70 percent since the height of the boom in 2007 and unemployment is at 14.3 percent, up 0.1 percent since this time last year. In 2007, it was just 4.6 percent.

Despite spending cuts and tax rises totaling 24 billion euros since 2008 (with another 8.6 billion euros to come before 2015) the country is still spending more than it raises in taxes. In 2011 it ran a budget deficit of 13.1 percent, 3.7 percent directly due to the nationalization of its banking debts, the remaining 9.4 percent due to the contraction of the economy.

The news seems to keep getting worse. Accountants Kavanagh Fennell today published a report saying business insolvency is on the rise, with 155 companies going bust in April. The construction sector was the hardest hit, followed by retail.

Labor union economist Michael Taft says government policy, including the proposed EU stability rules that forbid deficit spending, is what's stalling recovery.

"The domestic economy is still suffering from the deflation created by the austerity measures. We officially went back into recession in the last two quarters of last year and [when the statistics are published] may see no rise in the first quarter of this year," he says.

Meanwhile, declining incomes have led to a collapse in spending – consumption is down 12 percent from 2007 levels – and those who do have money rush to pay off debt, rather than spend, Mr. Taft says, explaining that stimulus is the only way to counter the problem.

"You've got to pump money into the domestic economy. It's like a patient dying of malnutrition," he says.

'No' vote brings together disparate forces

The governing center-right Fine Gael and center-left Labor parties are standing firm behind the treaty, as is centrist Fianna Fáil, Ireland's boom-time governing party that is now in opposition. But there are people on the left and right who are against austerity, united in their desire to say "no" to Europe's plan.

On the left, opposition parties Sinn Féin and the Socialist Party both urge a massive government spending program to kick-start the economy. "Paul Krugman's statement that austerity is a little bit like medieval doctors thinking they can bleed the patient back to health is a good summation of our views," says Sinn Féin's Eoin Ó Broin.

On the right, businessman Declan Ganley, who was prominent in opposing the EU's Lisbon treaty in 2008 and 2009, says EU policy is exacerbating Ireland's economic woes by forcing taxpayers to borrow money to pay the debts of failing banks. "If Europe wants to continue a policy of 'picking winners' by bailing out the biggest losers, that's their business, but the Irish taxpayer shouldn't pay a disproportionate amount of it," he says.

Mr. Ganley advocates increased European federalism and is campaigning for a "no" vote on the basis that banks should be allowed to fail. "It's about whether or not Ireland has any chance of recovery," he says.

Banking has been at the center of Ireland's property lending-fueled rise, as well as the subsequent crash in public finances.

In 2008, all deposits and funding bonds in Irish banks were guaranteed by the government. A year later, Anglo-Irish Bank and the Irish Nationwide Building Society were taken over by the state because they were unable to meet their debt obligations, primarily in real estate loans, putting taxpayers on the hook when it came to paying back the bondholders.

Later in 2008, the two largest banks in the country, Allied Irish Banks and Bank of Ireland, were also partly nationalized and, in 2009, each received 3.5 billion euro recapitalization payments from the state. By 2010, the cost to the state was too onerous, and the country entered the EU-ECB-IMF bailout program that has since defined its economic policy.

Distracted voters

Public opinion is divided, but to say the treaty is not the main issue in people's minds is an understatement. Despite wall-to-wall media coverage, public enthusiasm is low, prompting some Irish politicians to openly express fears of low turnout. Opinion polls indicate a win for the "yes" side, but up to 22 percent of eligible voters polled said they were still unsure just days before the vote.

Kevin Costello, a store owner from Nenagh, County Tipperary in the rural south of Ireland, says that he considered rejecting the treaty, but in the end he will be voting "yes."

"We can't live beyond our means," he says. "That's just common sense. I know from the shop – when your outgoings are so much greater than your incomings, you're in trouble."

Instead of the treaty, most attention is focused on the real economy. One point all agree on is that more money needs to be circulating.

"We opened the shop here 20 years ago and you can really see things have changed. The local economy benefited from the boom. Now we need to have people spending money again," says Mr. Costello.

"With a lack of investment and a lack of confidence, that's never going to happen."

Angela Nagle contributed reporting.