Boom and bust: How Indian billionaire’s rise left the nation vulnerable

Loading...

| Delhi

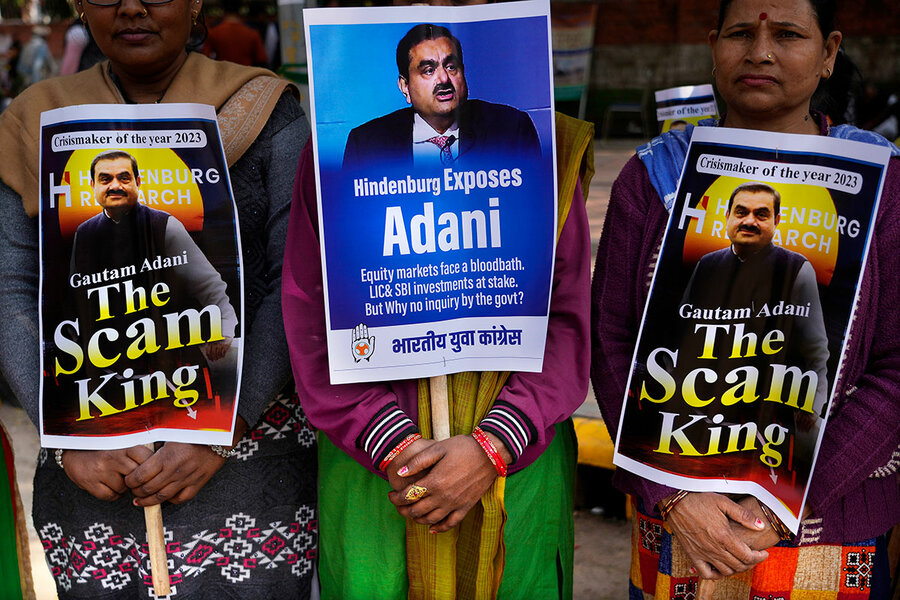

Indian businessman Gautam Adani began 2023 as Asia’s richest man, but that changed on Jan. 24 when a New York-based investment research firm accused the Adani Group of “pulling the largest con in corporate history.” Hindenburg Research alleges that, “with the help of enablers in the government,” the conglomerate engaged in stock manipulation, accounting fraud, and money laundering. The bombshell report says that seven of its key companies are debt-ridden and were at least 85% overvalued.

Adani stocks are crashing as the Securities and Exchange Board of India probes the allegations. In just a month, Mr. Adani’s firms have lost over $100 billion in value, and his personal wealth has reportedly halved.

The scandal raises questions about India’s political economy and its growth model – including whether Mr. Adani should ever have been allowed to accumulate so much wealth in the first place. The billionaire’s success is directly linked to the government’s mass privatization drive, with Adani enterprises winning bids and acquiring many public assets from airports to power firms. Even as other billionaires suffered last year, his wealth rose by $44 billion, a leap largely attributed to the Adani Group’s growing number of large-scale infrastructure projects in India. So intertwined are the tycoon’s personal wealth and the government’s pro-business agenda, critics wonder: is Mr. Adani a shining Indian success story, or the country’s most high-profile crony?

Why We Wrote This

A story focused onBillionaire Gautam Adani became a symbol of prosperity and economic opportunity in modern India. As his fortune comes under scrutiny, so does India's economic model and the country’s relationship with its super-rich.

Mr. Adani’s supporters are quick to dismiss the report, but for the government, the timing couldn’t be worse. India recently surpassed the United Kingdom to become the fifth largest economy in the world, and is looking to increase foreign investment. The Adani Group’s nosedive will affect not only the stock market, but also clean energy investment in the country, experts say.

“If a quarter of airport traffic, a third of port freight, and a third of grain warehousing is under infrastructure controlled by one group in a vast country like India, it suggests a high level of dependence on this group,” says Suyash Rai, fellow and deputy director at Carnegie India, a New Delhi-based think tank. “If the group gets into trouble, it can impact the larger economy.”

Adani and Modi rise together

While the Indian public market has always been dominated by family-run conglomerates and the country is no stranger to crony capitalism, experts say the scale of Adani Group’s growth and its acquisition of assets over the past decade have been astounding.

“Never before in the history of India’s post-independent political economy would you find such an exacerbated degree of almost obscene wealth accumulation in such a short span of time,” says Deepanshu Mohan, associate professor and director of the centre for new economic studies at the O.P. Jindal Global University in Sonipat, India.

The story of Mr. Adani and his corporate ascent are closely associated with that of 21st-century India – a connection underscored by the Adani Group’s 413-page response to the report, which called the allegations “a calculated attack on … the growth story and ambition of India” – as well as on Prime Minister Narendra Modi.

Both men hail from the state of Gujarat in western India, and the growth of their respective roles in the national sphere is seen as closely linked. Mr. Modi has enjoyed the billionaire’s enthusiastic backing since his time as Gujarat’s chief minister, and when he won the national elections in 2014, he flew to Delhi in Mr. Adani’s private jet. Mr. Adani’s business ventures, in turn, have also appeared to benefit from the close relationship, with his net worth increasing by more than 1,600% over the past nine years.

Mr. Adani began his foray into infrastructure in 1998 with Mundra Port, now the largest commercial port in the country, and entered the power generation business a decade later, eventually becoming the country’s largest private thermal power producer. He has announced ambitions to create 45 gigawatts of renewable energy capacity by 2030, in line with the government’s plans. His companies have also ventured into defense, data centers, and airport operation after the government relaxed regulations in the sector.

Yet this sort of market capture, experts say, does not actually contribute to India’s “growth story.”

Prosperity for a nation, or a nation’s elite?

In the annual budget announced a week after the Hindenburg report was released, the government increased its capital expenditure, particularly in infrastructure-intensive sectors, by a striking 37%. This, coupled with recent corporate tax cuts and incentives, reflects the government’s plan to attract private investment, says Mr. Mohan, but the strategy has been largely unsuccessful.

Private investment has actually dipped in the last decade, and small businesses have suffered. A handful of family-run conglomerates like Mr. Adanis’ have benefitted from these government measures, he adds, but the group’s investments were largely directed towards buying publicly-managed assets instead of creating them.

“That’s a point which a lot of people miss,” says Mr. Mohan. “It’s okay to have a big business growing bigger and bigger, but [only] if you’re creating assets will it create new jobs and more economic growth opportunities. Productivity is not increasing, the acquisitions have gone up, and the Adani group is using that to overvalue its stocks.”

This is especially stark considering that the government’s welfare spending has not kept up with the country’s rising poverty, hunger, and joblessness.

“There is a lot of propaganda about India’s growth story,” says Arun Kumar, retired professor of economics at Jawaharlal Nehru University.

For a true picture of the Indian economic model, he argues, it’s important to consider the high levels of unemployment and the decline in the unorganized sector which is estimated to make up over 90% of India’s total workforce. “Actually, the distress in the economy is rising,” he says.

Indians’ views on the super-rich

The report may have cost Adani billions and prompted rethinking among institutions – France-based TotalEnergies has put on hold a proposed green hydrogen joint project with the group and Bangladesh has sought to revisit a power deal with the company – but many regular Indians are unmoved.

Indeed, as India’s opposition parties raised questions in the Parliament about the Hindenburg allegations of government enablement and the prime minister’s closeness to Mr. Adani, Mr. Modi quipped that the trust of 1.4 billion Indians was his “protective shield.”

Delhi-based bank executive Risha Pandey blames the opposition for creating a stir. “This is all about politics. Things are already stabilizing and it will not affect the market or the customers in the long-run,” she says. “This will not affect my opinion or my vote. As an Indian citizen, I am only concerned about India’s progress and there has been a big difference in the last ten years.”

Her reaction is in line with many Twitter users who evoked nationalism in support of Adani following the report.

However, there are others, like financial analyst Raj Pandey (not related to Risha Pandey), who agree that Mr. Adani’s story is tied to India’s but see the journey as one of cronyism and exploitation, not of mutual prosperity. Mr. Pandey believes the report and in the past has advised his friends against investing in Adani stocks.

“If I was seeing this happen for the first time, I’d feel anguished. But as an Indian, I’ve become used to it,” he says. “If an Indian among us rises up with sheer hard work, then there’s nothing wrong in celebrating it, but if he’s gotten there through manipulation then we shouldn’t [be supporting that].”

Avijit Ghosh, a fashion designer, says he’s acutely aware of how hard middle-class Indians need to work while crony capitalism ensured some individuals got wealthy in a short time. He feels that “there would be many Adanis in the future” if there isn’t a systemic shift in how Indian politics works.

“There can’t be quick fixes anymore. We have to pull [cronyism] by the roots,” he says.