Africa's energy consumption growing fastest in world

Loading...

| Nairobi, Kenya

As the sun sets over Africa each day, instead of flicking a light switch or heating up the oven, most people put a match to a kerosene lantern or a burning ember to a charcoal stove.

Africa, home to 15 percent of the world’s population, consumes just 3 percent of the world's energy output, and 587 million people, including close to three-quarters of those living in sub-Saharan Africa, still have no access to electricity via national grids.

But the situation is changing, and swiftly. At 4.1 percent growth, Africa’s per capita energy consumption is growing faster than that of any other country, driven by improved infrastructure, inward investment, and efforts to tackle corruption.

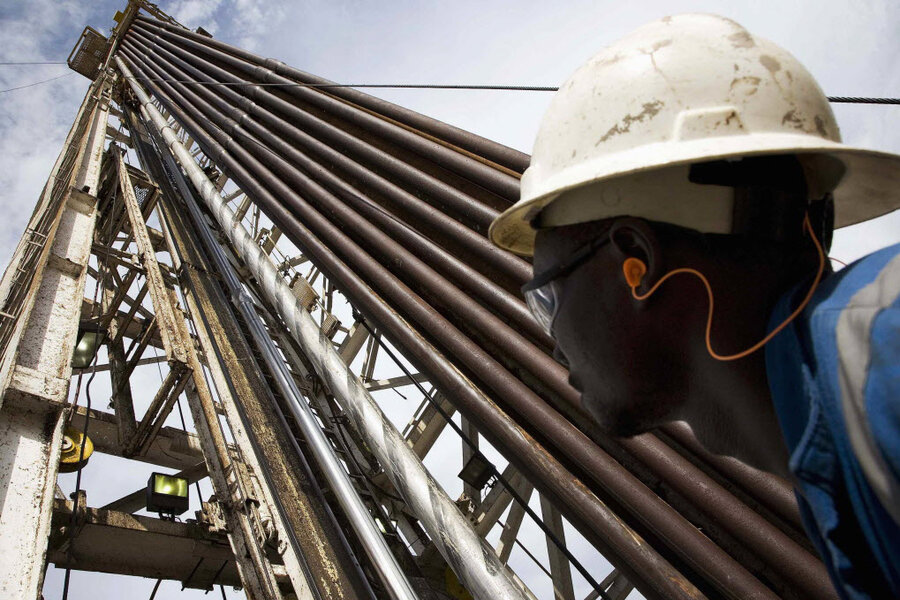

Meanwhile, in the past five years, there have been 64 major discoveries of potential new fuel supplies – mostly oil and gas deposits. Of those, 13 were found in the first eight months of 2012 alone.

“The potential impact is ginormous,” says Bob McBean, former managing director of Dubai Natural Gas Company and now chairman of Wentworth Resources, an oil and gas exploration and production firm in Tanzania.

“It’s very, very exciting, and it constantly puts me in mind of natural resource finds in the Gulf 20 years ago. Assuming everybody comes onto the same page in terms of financing and regulation, there’s no reason why there should be any national power shortages at all in the future,” he adds.

Holding Africa back

That ambition cannot be realized too soon.

Currently fewer than 1 in 6 rural Africans is connected to a national electricity supply. Even in the continent’s more developed nations, the situation is dire: 84 percent of Kenyans, 81 percent of Ugandans, and 65 percent of Sudanese are off the grid.

Using kerosene lanterns and charcoal cookstoves at home causes as many as 1.4 million premature deaths from respiratory illnesses, according to the World Health Organization. Chopping down trees to burn as fuel harms the environment more than coal-fired power stations.

“Using inefficient energy sources both in energy and economic terms continues to keep large sections of [Africa’s] population from the benefits of development,” said Aly Ngouille Ndiaye, Senegal’s minister of energy and mines.

The continent’s growth cannot be accelerated without addressing the lack of reliable energy supply on a continent clearly endowed with untapped fuel resources, he added.

Generators sap profits

Businesses desperate to be competitive in an increasingly global marketplace despair as bills to fuel and service generators clip several crucial percentage points off their profits.

There are significant moves to expand renewable energy production across Africa.

A British firm announced this month that it will build the world's fourth-largest solar power plant in western Ghana, a 155-megawatt project that will be operational by 2015 and increase the country's electricity supplies by 6 percent.

The continent’s largest wind farm is being built in northern Kenya. South Africa already draws 5 percent of its power from nuclear plants, and research continues into a small-scale reactor that analysts argue could be the most innovative way to power off-grid corners of the continent.

Too little, too slow

But wind and solar do not provide reliable supplies, and hydroelectric schemes are at the mercy of the changing climate.

Alternative energies with greater efficiencies are also beset by a lack of trained staff and can take up to 20 years to bring regular power to national grids, according to the World Energy Council.

“Renewables will not happen immediately,” said Tony Surridge of South Africa’s National Energy Development Institute.

“From a realistic viewpoint, fossil fuels are highly concentrated and so it will be decades before there is a direct confrontation between renewables and fossil fuels. Developing countries have to make trade-offs, especially considering the need to double the output of electricity over the next 20 years.”

Challenges remain, not least a lack of coordinated structures in regional regulations governing the energy industry, and the need to attract significant international investments into markets until recently seen as high risk.

“It is not wrong to hope that in the future, these new natural resources will bring a true benefit to ordinary citizens,” says Subiro Mwapinga, an oil and gas industry expert based in Dar es Salaam, Tanzania. “But the fact remains that there are great problems with the transparency of contracts being issued, and a deep misunderstanding among the ordinary population of what the gas we have found means to them.

“These are things that will take a long time to overcome. We will not be Qatar or Dubai overnight.”

Corruption obstacles

Implicit in Mr. Mwapinga’s analysis is a recognition that Africa’s energy sector has been notorious for corruption.

A recent study estimated that Nigeria had spent more than $40 billion reforming its electricity industry for less than 10 percent additional power supply.

Angola has been praised for constructing roads, ports, universities, and hospitals with the windfall from its oil supplies, but global governance watchdogs claim as much as $32 billion went missing from its export receipts between 2007 and 2010.

However, international analysis suggests that the tide is turning against entrenched corruption, and investors should not be deterred.

“While the risk rankings overall in Africa are quite high, for many countries the ‘risk trend’ is improving,” says Elias Pungong, oil and gas sector lead analyst for Ernst & Young in Johannesburg. “Most importantly though, the opportunities for Africa in this sector are enormous, and the challenges and risks can be addressed and mitigated.”