Social Security deadline: how recipients can switch over from checks

Loading...

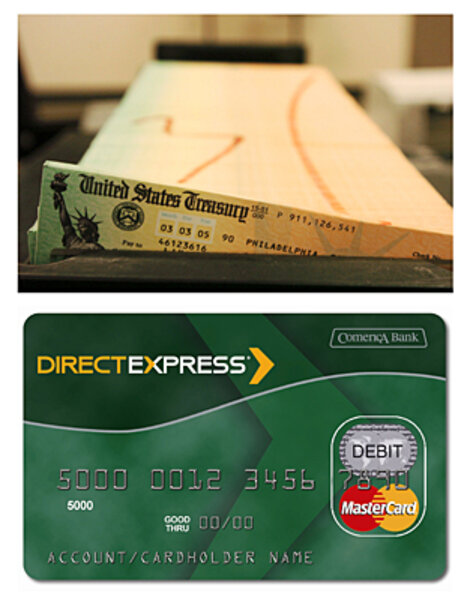

The Social Security check will no longer be in the mail.

Not after March 1, that is.

With rare exceptions, the Social Security Administration is requiring people who still get their benefits by check to switch to some kind of electronic transfer.

What does that mean in 10 days for people who don’t have bank accounts? Or for people who, for some other reason, aren’t ready for direct deposit?

Say hello to the Direct Express card, which looks and acts much like a bank debit card. It bears the MasterCard logo and is issued by the banking firm

Comerica, which was enlisted by the Treasury as a financial agent.

The Treasury is recommending that people either set up direct deposit for Social Security payments or sign up to have their payments transferred monthly to a Direct Express card, which can then be used to pay bills and obtain cash.

“People who do not choose an electronic payment option by March 1, 2013, will be out of compliance with the law,” the Treasury warns on the Go Direct website it sponsors, which promotes the paperless processing effort.

Already, as of last fall, about 94 percent of America’s 60 million Social Security recipients were receiving benefits electronically in some way. But that still left more than 3 million people getting payments by mailed checks.

The Treasury's Go Direct campaign recommends that people who now get checks take the following steps:

• Decide if you want to do direct deposit to a financial institution or get a Direct Express card. You can call the Treasury's Electronic Payment Solution Center at 800-333-1795 for more information. Either way, it can be helpful to have a copy of your most recent Social Security check in hand.

• To sign up for direct deposit, the account number and routing number for your financial institution will be needed. You can call the phone number above, or visit the Go Direct website (godirect.org) to sign up.

• To sign up for the Direct Express card, call the number above.

People applying for new Social Security benefits should be ready to sign up for direct deposit or a Direct Express card when they apply.

For current recipients who fail to comply with the new requirement, the Treasury may mail them a Direct Express card and contact them by mail about their options.

Exceptions to the rule are rare. People born before May 1921 won’t have to switch. Ditto for some people in remote rural areas, or someone judged to have a mental impairment to handling payments electronically (and who is not assisted by a representative payee).

The federal government estimates it will save $1 billion over the next decade by making the switch.

The government also promotes the change as offering consumer benefits: Money goes quickly and efficiently to recipients, with no worry about paper getting lost in the mail or slowed by a blizzard.

The money that flows into Direct Express accounts each month will be insured by the Federal Deposit Insurance Corp., just like traditional bank accounts are. Basic account features come without fees, while some optional features (paper statements, transactions outside the United States) carry modest fees.

For each deposit received, one cash withdrawal from an ATM is free. Subsequent cash-machine withdrawals come with a 90 cent fee.

Still, benefit recipients need to be on guard against potential for scams.

Criminals sometimes use fraudulent phone calls or e-mails to obtain personal information from beneficiaries, the Social Security Administration warns. That opens the door to forms of identity theft – including redirecting benefits by changing to a new account for direct deposit.