Income inequality: States struggle to balance budgets as rich-poor gap widens

Loading...

| Washington

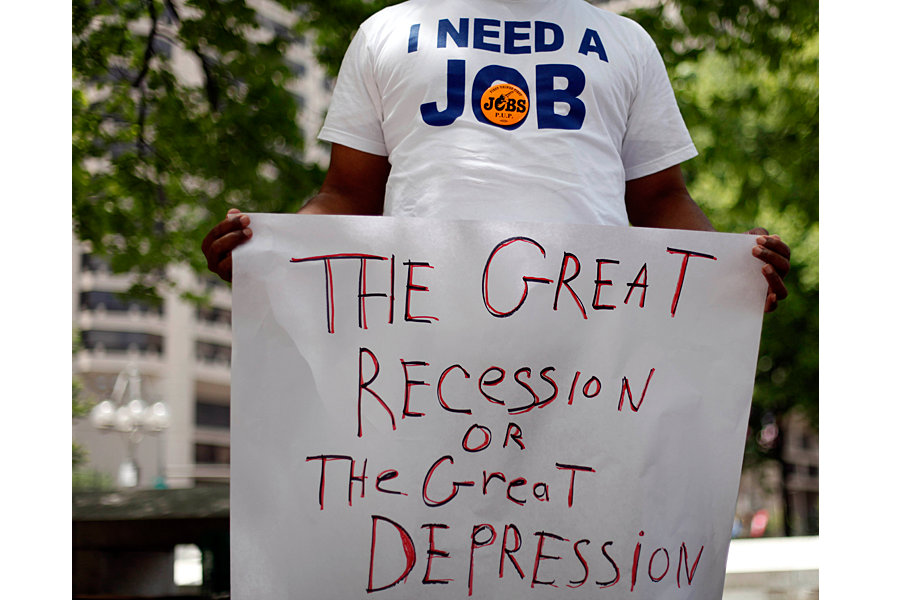

A widening gap in incomes between the rich and the middle class may be hitting US states where it hurts – making it harder for them to raise the tax revenue they need for balancing their budgets.

This conclusion, reached in a report released Monday by Standard & Poor’s, comes at a time when states across America are still struggling to rebuild their revenue streams more than five years after the end of a historically deep recession.

In most states, tax revenue growth has not kept pace with growth of the overall economy since the recession, according to data tracked by the US government. And in many states, tax revenue is still below its pre-recession peak.

The report by S&P pushes for considering inequality as a key reason for the revenue shortfall.

“Greater inequality may be associated with simultaneously slower and more volatile state tax revenue growth,” writes S&P credit analyst Gabriel Petek, citing research aided by economists at the credit-rating firm.

The report’s conclusion adds a new layer to already-hot public debate about income gaps in America, and the degree to which inequality is squeezing not only particular groups of Americans but the whole economy, too.

In a new Pew Research Center poll, 57 percent of registered voters said they consider economic inequality a “very important” issue in determining who they'll vote for in congressional elections this fall.

A separate Pew poll found 56 percent of Americans saying their incomes are “falling behind” the cost of living. But at higher income levels, a majority said their incomes are either staying even or going up faster than living costs.

Those perceptions have been documented by economists as a financial reality of recent decades, as incomes at the top end of the spectrum have surged while middle-tier incomes have struggled to match inflation.

S&P acknowledges that a correlation between two trends doesn’t always mean that one is caused by the other. But economists at the firm argued in a recent analysis that “at extreme levels, income inequality can harm sustained economic growth over long periods.”

The firm, citing the United States as near these extreme levels, reduced its 10-year growth forecast for the economy to a 2.5 percent annual rate, down from 2.8 percent five years ago.

Already, in the new millennium, the pace of US economic growth appears to have slowed from historic norms.

The challenges for state tax revenue flow largely from that wider challenge to economic growth. The faster the overall economy grows, the faster state tax receipts tend to rise.

Beyond that, though, states face a particular challenge: When a larger share of overall income goes to the rich, it means also that more income is coming in the form of capital gains on stock rather than traditional wages.

So, in addition to experiencing lean times, states are generally in an era of higher volatility in their fortunes – with big ups and downs in taxes tied to stock market trends and the behavior of investors.

The new report argues that, despite this volatility problem, tax hikes on upper-income residents are one approach states can take in trying to close revenue gaps, while also ameliorating inequality. But some of the states with the highest inequality (California, New York, New Jersey, Connecticut) have already raised their top marginal tax rates in recent years, the report says.

Traditionally, inequality has often been viewed as more of an aid to economic growth than a hindrance. Gaps in income represent free-market forces, the incentives by which entrepreneurial people can reap the rewards of new ideas and skills. That, in turn, helps the whole economy grow.

Today, some economists at places like the International Monetary Fund and S&P are arguing another side to the coin – that too much inequality can damage growth if it starts to corrode political systems or to impede the spread of skills and productivity to a wider set of workers.