Whatever happened to the great 'sequester' smackdown?

Loading...

| Gales Ferry, Conn.

After a busy lunch hour, waitress Missy Tirrell stops to talk about how federal spending cuts might affect Mo's, a burger joint that counts on sailors and government contractors for its business.

Civilian Navy contractors who work in nearby Groton, Conn., a big home port for the submarine fleet, have been talking about how they expect to start losing one day of pay a week because of furloughs, she says. And she's heard of other civilian workers checking out of a local motor inn months earlier than expected.

"We're not feeling it yet," she says. "But I'm sure we will."

Indeed, that seems to be the case across the United States: There might not be many signs of the "sequester" so far, but this summer, the effect of $85 billion in cuts this year is expected to become more visible.

The sequester was designed to be so draconian that just the threat of it would push lawmakers to the bargaining table to come up with another fiscal plan. But with legislators in no mood to negotiate budgetary matters, the sequester took effect March 1.

And not much appeared to happen.

But now, about four months later, the cuts are starting to take hold. Hundreds of thousands of government workers have either started furloughs or will by mid-July. Many organizations – especially those with government contracts – are expected to reassess their hiring plans. And federal programs such as Head Start are being curtailed.

Consumers affected by such cuts are, in turn, expected to pare their own spending – on everything from restaurant meals to the purchase of new cars.

"It looks like the third quarter is when the furloughs will really hit," says Mark Zandi, chief economist at Moody's Analytics in West Chester, Pa. "The script is still being written."

Probably the most visible sign of the sequester came when the Federal Aviation Administration furloughed air-traffic controllers at the end of April, resulting in long flight delays. But Congress quickly remedied that problem by giving the FAA more flexibility in its budget.

To see how the sequester may still have an impact, a look at California's recent furloughs of public employees may be instructive. As the state struggled to balance its budget, it resorted to the furloughs from 2009 to 2012. Furloughs have even continued for some unions this year.

Those cutbacks cost public employees annually anywhere from 5.5 to 14 percent of their paychecks, depending on the department. The average amount of wages lost for the 95,000 state workers represented by SEIU Local 1000 (Service Employees International Union) was $16,059 for the 2009-12 period, estimates Randy Cheek, a lobbyist for the union at the state capital, Sacramento.

"We had people who lost their homes, lost their cars. One member gave up the children to the parents," says Mr. Cheek, who estimates the average member makes about $30,000 per year. "Even one furlough day a month was hard on people: It caused a lot of stress."

While the losses were tough for the public employees, it's less clear that the furloughs affected the general California economy. According to the US Bureau of Labor Statistics (BLS), the most layoffs in the Golden State took place in 2008 – the year before the furloughs and a time when the real estate market was collapsing. From 2009 to 2012, there were no major changes in many key employment categories.

The state furloughs were more of an "annoyance factor," says Christopher Thornberg, founding partner of Beacon Economics in Los Angeles. "You need something done and no one is there," he says, describing the frustration of dealing with the bureaucracy in Sacramento.

However, Mr. Thornberg says, the furloughs and other spending cuts resulted in a drag on the California economy for the past several years. "If you subtract government, the economy would have improved," he says.

The memory of the California cuts is still fresh for Neal Andrews, a city councilman in Ventura, Calif. The city had to reduce spending, which meant some layoffs, among other things, as funds from Sacramento shrank.

Now he worries that the federal cutbacks could cause yet more hardship. The area has two Navy bases that contribute about $2 billion to the local economy. "We have hundreds of scientists and engineers who live in our city, and if they find themselves with less, it will have a big impact on us," Mr. Andrews says.

A retail sales tax represents 15 percent of Ventura's budget, he notes. "So if [people] delay making major purchases, not replacing cars or washing machines, or eat out less, a reduction in sales taxes will have an impact," he says.

As it turns out, the sequester cuts may be arriving at a time when the economy is getting a little stronger. On June 20, Federal Reserve Chairman Ben Bernanke said that the Federal Open Market Committee, which sets interest-rate policy, "sees the economy continuing to grow at a moderate pace, notwithstanding the strong head winds created by current federal fiscal policies."

If Mr. Bernanke is correct that the economy appears to be floating over the fiscal shoals, the effect on the economy could be mitigated. Last fall, the nonpartisan Congressional Budget Office predicted the sequester could cost the economy about 750,000 jobs this calendar year. Now Mr. Zandi thinks the cost to the economy might be 25,000 jobs a month, or about 250,000 jobs.

"Job growth has come down a notch, but only a notch," he says.

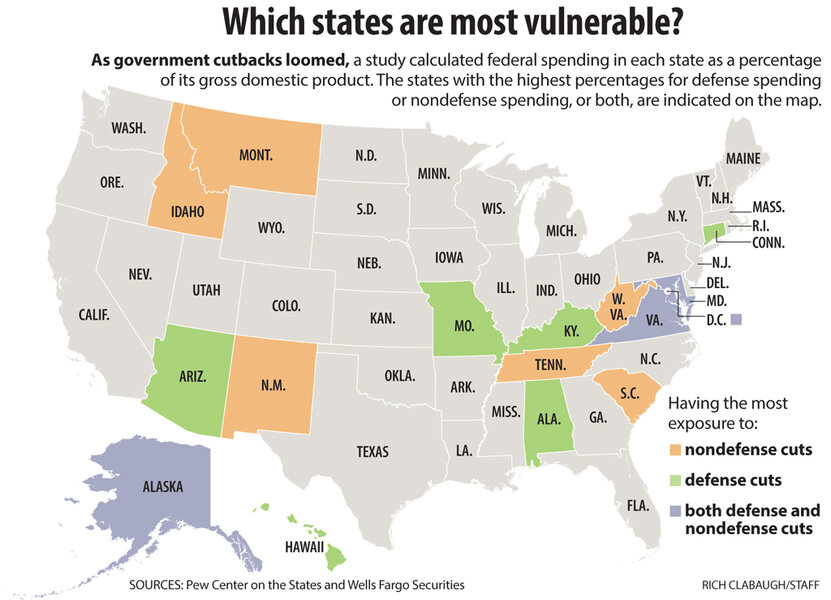

So far, there's scant evidence that the sequester has affected the unemployment rate, even in states that are expected to feel the most effects. (See map.) The unemployment rate in Hawaii, which derives almost 16 percent of its state gross domestic product from the federal government, was 4.7 percent in May, down from 5.1 percent in March, according to the most recent BLS data. Even the District of Columbia, which gets almost 20 percent of its GDP from the federal government, saw its unemployment rate drop marginally between March, when the federal cutbacks started, and May.

But back in Connecticut, Stan Cardinal, owner of Cardinal Honda in Groton, just down the road from the Navy base, says the federal cuts have already had a personal impact: As a former submariner, he used to be able to occasionally bring his sales staff to the base for lunch. Recently, he was told that this perk had ended, since some of the people who work in the galley had been let go.

However, he doesn't think the cutbacks will be too hard on his business.

As he sits in his office above the showroom, he says that in the past when the economy shrank, his business shifted from sales of new cars to service. Eventually, it shifted back.

"A person can survive a 20 percent pay cut," Mr. Cardinal says. "It won't be pleasant, but it won't last forever."