Insider trading bill: A model to end gridlock on Congress?

Loading...

| Washington

After months of gridlock, the Senate on Thursday passed two measures to ban insider trading on Capitol Hill and help small businesses raise capital.

The Stop Trading on Congressional Knowledge (STOCK) Act heads to President Obama’s desk, while the Jumpstart our Business Startups (JOBS) Act is slated for a conference committee to resolve differences between the House and Senate over investor protections, especially involving fundraising over the Internet.

The message that lawmakers hope that the public takes away from the Senate vote comes down to this: Congress can work. Even amid stark partisan divisions, bills with bipartisan support can rocket through Congress, if members conclude that notching minor legislative achievements for both sides outweighs heading into an election season where voters, enraged by gridlock, throw all the bums out.

“Bipartisanship often survives not because people are feeling good or feeling civil, but because it’s in the interest of both parties to play ball at something,” says Julian Zelizer, a congressional historian at Princeton University in New Jersey.

“In both cases, [the bills passed Thursday] are not items that are so high visibility that they’ll cause that much discussion. Both those measures are important, but it wasn’t like health care. And so it’s something, ironically, the parties can agree on and not anger everyone in their base.”

The STOCK Act, which had languished for more than half a decade, was propelled into the national conversation by a scorching report on CBS’s "60 Minutes” last November. The bill bars members of Congress and staff from trading stocks based on nonpublic information obtained in their work. The House version of the bill passed by unanimous consent, after clearing a key procedural vote, 93 to 3.

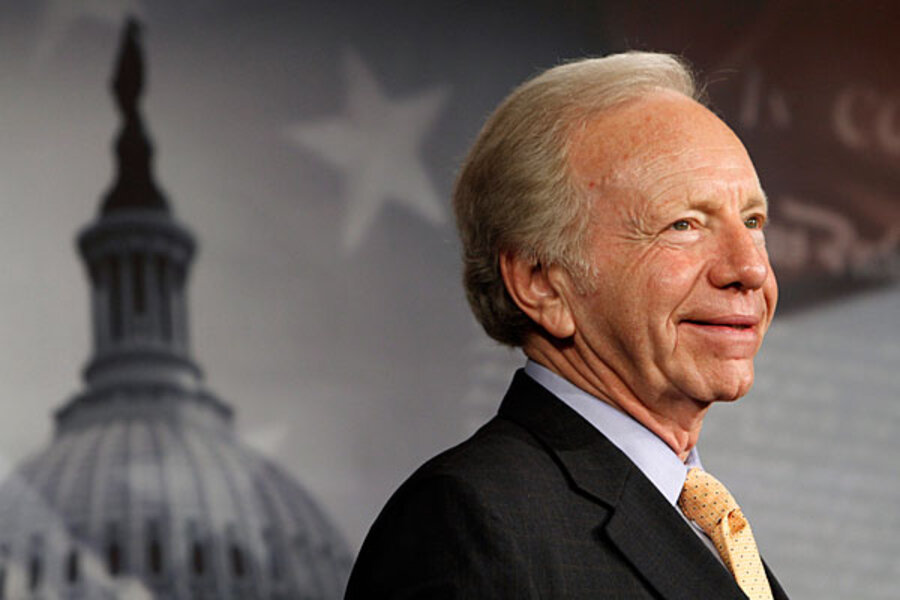

“Here’s a case where a problem was identified that cut directly to the public’s faith in their elected representatives,” said Sen. Joseph Lieberman (I) of Connecticut, who introduced the bill, in comments to reporters after the vote. “We dealt with it quickly and on a bipartisan basis in both houses of Congress. Hopefully, this will be a model for other critical legislation.”

The stakes for the pending “critical legislation” before Senator Lieberman's Homeland Security and Government Affairs Committee – cybersecurity and reforming the US Postal Service – however, involve far higher stakes than clamping down on members’ brokerage accounts.

“The amount of trading that’s going on in Congress, even if we assume a worst-case scenario, is much too small to move the market,” said Rich Smith, a senior analyst at The Motley Fool, an investing website popular with hobbyist investors that has backed the STOCK Act. “But it looks bad. It destroys people’s faith in the market being a level playing field.”

The JOBS bill, on the other hand, with its PR-savvy name and wider-reaching aims, will have more of an impact on the public. The bill unites proposals allowing small businesses to raise money from small investors (known as crowdfunding), relaxing regulation for firms entering the public market, and allowing small firms to solicit investments via advertisements. It passed on a big, bipartisan vote, 73 to 26.

Nick Bhargava, a co-founder of crowdfunding website Motaavi, says that by stitching the bill's various proposals together, Congress may have established a new pathway for businesses to move from innovative idea to a place on the New York Stock Exchange.

“When you look at [elements of the JOBS Act] as a package, they all fit nicely together,” Mr. Bhargava says. “If you do this together, we think the long-term effects can be pretty significant, and you have a well-defined legal framework for the next great American company.”

Still, as many of the 26 Democrats who voted against the JOBS legislation pointed out, the bill has rather modest potential in the near term.

“The supporters of this bill claim it will help create jobs. They have even titled it the JOBS Act. But there is no evidence it will help create new jobs,” said Sen. Carl Levin (D) of Michigan on the Senate floor on Thursday. “There is not one study that its proponents have shown us how repealing provisions that protect us from egregious conflicts of interest ... will create jobs.”

John Engler, president of the Business Roundtable, told reporters at a breakfast sponsored by The Christian Science Monitor on Thursday that while the JOBS measure is important, “I would say just keep on going."