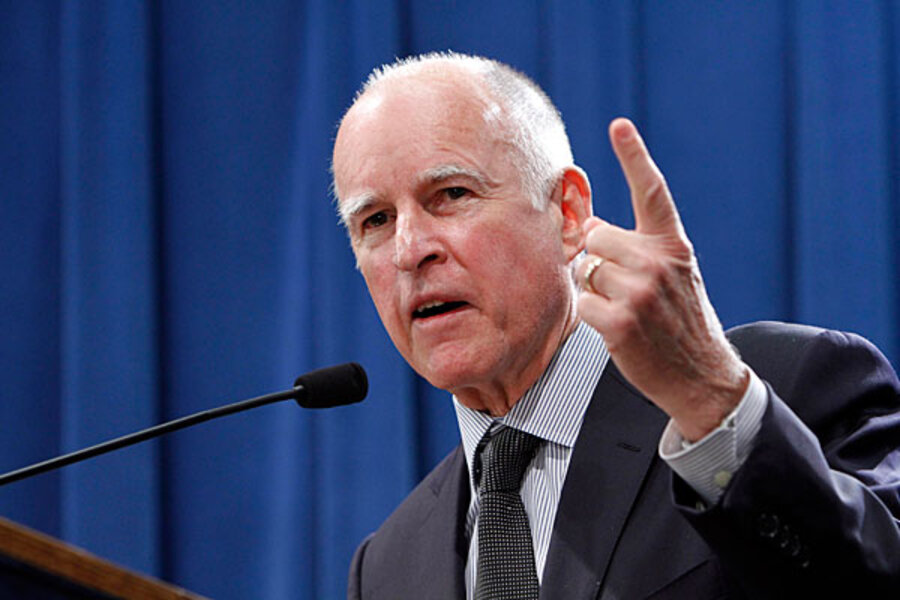

Gov. Jerry Brown implores California voters: Please raise taxes on yourself

Loading...

| Los Angeles

Gov. Jerry Brown on Monday proposed a ballot initiative that would ask Californians to raise taxes on themselves.

Facing huge deficits despite $10 billion in budget cuts last year, California needs new tax dollars in order to avoid catastrophic cuts to schools and government services for the elderly, Governor Brown said.

His plan includes a 1 percent income-tax-rate increase for individuals making more than $250,000 per year, and a 2 percent rate increase for those making more than $500,000. It would also increase the state sales tax by half a cent to 7.75 percent.

In total, at least 10 initiatives that propose tax increases are vying to qualify for the 2012 ballot in California – a sign that the state that led the national tax revolt with Proposition 13 in 1978 might now be considering at least a partial reversal of course.

With many states still focused only on cuts, such a bold statement from California could reverberate nationwide – either giving other states cover to try similar measures or showing that, even with budgets in dire straits, tax increases are a political impossibility.

“A victory for tax increases in California could encourage similar moves in other states,” says Jack Pitney, a political scientist at Claremont McKenna College. “If the tax measure goes down to defeat – in a blue state running a huge deficit – the effect would be to chill such proposals in other states for many years to come.”

Brown’s proposal is projected to raise $7 billion per year and would expire in 2016. On Monday, he dismissed the idea of going through the Legislature, where a two-thirds vote is needed for raising taxes. Indeed, Brown tried to go through the Legislature earlier this year to get a tax measure put on the ballot, but Republicans blocked him.

So now the plan is to collect enough citizen signatures to put his plan on the ballot without any input from lawmakers.

“I am going directly to the voters because I don’t want to get bogged down in partisan gridlock as happened this year,” said Brown in a statement. “The stakes are too high.”

He suggested that the state can’t make any more cuts responsibly. “Spending is now at levels not seen since the ’70s,” he said. “Schools have been hurt, and state funding for our universities has been reduced by 25 percent. Support for the elderly and the disabled has fallen to where it was in 1983.”

“The stark truth is that without new tax revenues, we will have no other choice but to make deeper and more damaging cuts to schools, universities, public safety, and our courts,” he added.

The depth of recent cuts may have changed minds in California. Some 64 percent of California voters said they would pay more taxes if the money went to public schools, according to a November poll by the Los Angeles Times and the University of Southern California.

“Now people are seeing how spending cuts are hitting the most vulnerable – elderly and kids in school,” says Loyola Law School professor Jessica Levinson, former director of political reform at the Center for Governmental Studies.

But analysts say the sheer number of initiatives may overload voters. Moreover, Republicans could try to counter with initiatives of their own.

“While Brown may be successful in persuading some of his allies in his tax-increase battle to remove their initiatives from the ballot, one might imagine that his opponents will decide to pursue a voter misdirection strategy by seeking to add counterbalancing initiatives of their own,” says Lara Brown, a Villanova University professor and author of “Jockeying for the American Presidency.”

The stakes are high for what might follow in other states. “In the same way that Proposition 13 did, indications are that California is willing to turn the corner on what government is and our willingness to fund it,” says Barbara O’Connor, director emeritus of the Institute for Study of Politics and Media at California State University, Sacramento. “Perhaps it is time to lead the rest of the country out of the morass by example.”