Federal Reserve chair: Congress shouldn't cut budget too much, too soon

Loading...

| New York

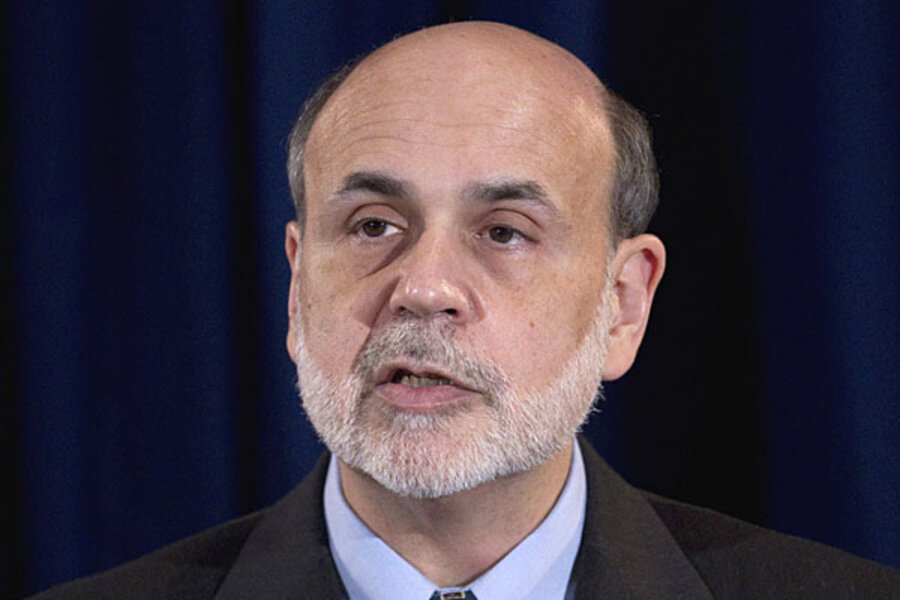

The chairman of the Federal Reserve, Ben Bernanke, has some advice to all those hatchet-wielding budget cutters in Washington: Don’t cut too much, too soon.

Instead, Mr. Bernanke, at a press conference, suggested that Congress should focus on cutting the deficit over the medium to long term.

“In light of the weakness in the recovery, it would be best not to have a sudden and sharp fiscal consolidation in the very near-term,” he says. “It would be a negative for growth.”

Bernanke’s advice to members of Congress moves him much closer to the Democrats who are trying to prevent programs from landing on the scrapheap. Yet Bernanke also sided with the Republicans when he said that “the sooner we act” on the budget issue, the better off America will be.

In short: To the Fed chairman, it is a question of timing.

“This is consistent with what he has been saying,” says Marc Goldwein, policy director for the Committee for a Responsible Federal Budget, a watchdog group in Washington. “Enacting the plan now but that does not mean that all the cuts have to be in the first year, but instead they can come gradually and give the economy time to recover.”

Rep. Paul Ryan (R) of Wisconsin, the House Republicans’ lead budget negotiator, has suggested reducing spending this year down to the 2008 level. One reason he wants to slice the budget now is to make sure the cuts actually happen.

On the other hand, a bipartisan group led by Vice President Joe Biden is talking about making longer-term cuts, more in line with Bernanke’s suggestion. “They are looking out over a 10-year window,” Mr. Goldwein says.

The Fed chairman’s advice comes at the same time that the nonpartisan Congressional Budget Office (CBO) issued a report on the long-term budget outlook. Over the next few years, the CBO said, the budget deficit will probably decline “markedly” as the economy continues to recover and the stimulus money is phased out. But for the coming decade and beyond, the CBO called the prospects “daunting.”

Under one CBO scenario – in which the Bush-era tax cuts remain in place, the alternative minimum tax is adjusted to help the middle class, and Medicare payments to doctors are not reduced – US debt held by the public would exceed gross domestic product by 2021. After that, the growing imbalance between revenue and spending, combined with spiraling interest payments, would push debt to higher and higher levels.

“Debt as a share of GDP would exceed its historical peak of 109 percent by 2023 and would approach 190 percent in 2035,” the report said.

Republicans were quick to use the report as a rationale to cut spending. “This latest warning demonstrates the urgency in which we have to slash our debt,” said Sen. Orrin Hatch (R) of Utah in a press release.

While Bernanke agrees on the need for urgency, he says it would be bad policy for big cuts to happen immediately. “If it’s entirely focused on the near-term, I don’t think that’s the optimal way to proceed,” said Bernanke, who recommended focusing more on five to 10 years down the road.

If Congress does that, he says, it will increase consumer confidence and reduce the risk that interest rates will rise suddenly.