Detroit bankruptcy: Judge to decide whether city hoodwinked opponents

Loading...

The city of Detroit on Wednesday will ask a federal judge to declare it financially insolvent, paving the way for what will likely be the largest municipal bankruptcy in US history.

The trial, which is expected to last through next Tuesday, will pit the city against two of the state’s largest labor organizations, among other objectors. At issue will be whether the city negotiated in good faith this year in its efforts to avoid petitioning the court for Chapter 9 protections.

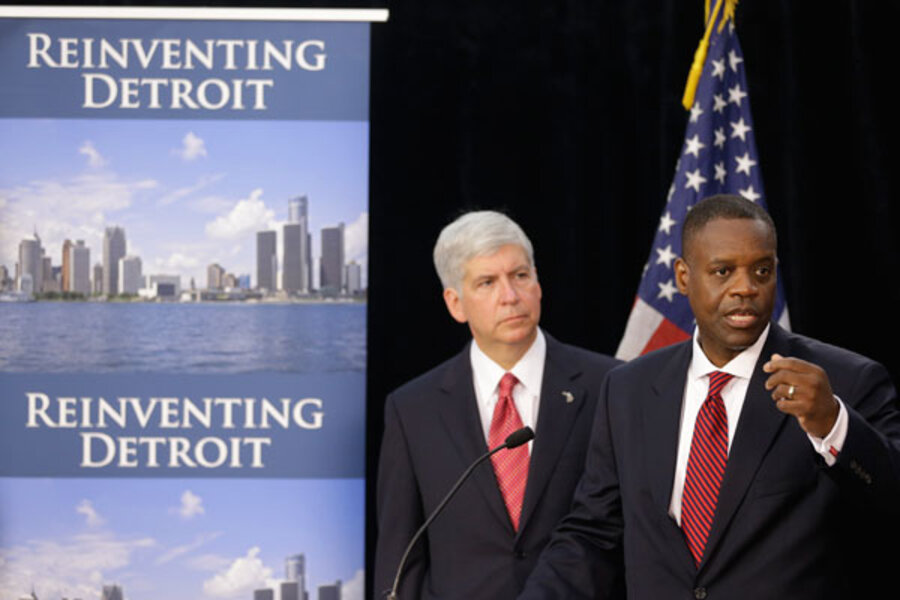

Labor organizations say Michigan Gov. Rick Snyder (R) was determined to take Detroit into bankruptcy when he appointed emergency manager Kevyn Orr in March. They want US Bankruptcy Judge Steven Rhodes, who is presiding over the trial, to allow Governor Snyder to take the witness stand and undergo questions from union attorneys. The state says Snyder’s testimony is unnecessary, and so far, Judge Rhodes has indicated there is no reason the governor should answer questions under oath in the courtroom.

Whether Snyder testifies or not, bankruptcy experts generally agree that Rhodes is almost certain to find Detroit insolvent. In court filings, Detroit reported it suffers from $18 billion in debt and long-term liabilities and does not have enough cash over the long term to provide adequate services.

“The bigger news would be if Detroit is not declared insolvent,” says Michael Sweet, a bankruptcy attorney with Fox Rothschild in San Francisco. “At the end of the day, the city should prevail.”

Labor organizations, particularly the Michigan Council 25 of the American Federation of State, County and Municipal Employees (AFSCME) and the United Auto Workers (UAW), dispute the city’s data. Yet the larger fight is expected to focus on whether the city negotiated in good faith.

Labor groups say Mr. Orr and his team did not do enough to seek routes other than bankruptcy, such as selling or leasing assets or more substantive negotiations with public-employee unions. Orr says that he had no hidden agenda and that negotiations didn't work because his opponents were suing the city.

Joining the opposition in court are the city’s two pension funds and a committee representing the city’s 23,500 retirees. They say a Chapter 9 bankruptcy violates the state constitution that guarantees public pensions. Orr has remained quiet on this issue and, outside the bankruptcy proceedings, has sought to shift legacy costs onto both employees and retirees.

Earlier this month, he announced that, starting Jan. 1, retirees younger than age 65 will no longer receive their $605-per-month health insurance coverage but will instead receive a $125 stipend to use for a private plan under the federal Affordable Care Act. Retirees older than age 65 will be enrolled in a Medicare plan but will be responsible for paying their own deductibles. Several retiree groups filed a lawsuit in federal court Tuesday to block Orr’s changes.

Rhodes will not take up this issue, instead confining himself to a ruling on the city's eligibility for bankruptcy. But he could set a date months down the road to address the constitutionality of Detroit's bankruptcy maneuvers. At that point, Orr will submit a financial restructuring plan for approval, which may or may not include cuts to pension obligations.

“The most interesting argument is the one involving the state constitution and whether pensions can be impaired,” Mr. Sweet says. “But that is a discussion for another day.”