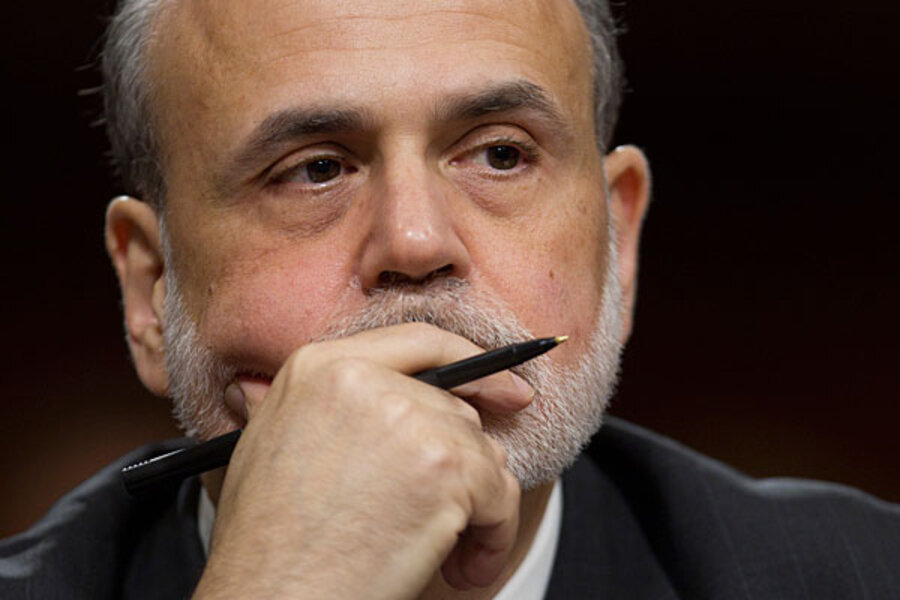

Senators push Bernanke: Was Fed asleep in the LIBOR rate scandal?

Loading...

The chairman of the US Federal Reserve came under pressure Tuesday to explain what role his institution played in the scandal over the LIBOR, an interest rate that serves as a benchmark for numerous other lending rates in the global economy.

Ben Bernanke told a Senate Committee that Fed officials pushed for reform of the rate-setting process in 2008, when it became clear that the LIBOR system was subject to manipulation by private sector banks. The LIBOR, which stands for London Interbank Offered Rate, is set based on voluntary reports by private banks -- rather than by observable transactions such as prices on bond trades.

Chairman Bernanke said the Fed in 2008 gave a substantial response by alerting other regulatory authorities and by making recommendations to officials in Britain, where a bankers'association helps to manage the LIBOR calculations.

"Why have we allowed it to go on the old way when we knew it was flawed?" Sen. Pat Toomey (R) of Pennsylvania asked.

"Because the Federal Reserve had no authority to change it," Bernanke replied.

"You have enormous influence," Senator Toomey retorted.

Controversy over the rate-setting process has emerged in recent weeks, as news reports have focused on the role of Barclays, one major bank that will pay $453 million in fines for falsely reporting its borrowing costs, and thus distorting the LIBOR benchmark.

LIBOR is used as a guide for numerous financial contracts, such as adjustable rate mortgages, that affect consumers and business.

Bernanke described the issue of LIBOR manipulation as a two-part problem. First, banks under-reported their costs from borrowing from other banks -- a move that stood to benefit them during the financial crisis that began emerging in 2007. Second, it appears that banks provided false borrowing-cost reports to enable their own traders to make profitable investments tied to LIBOR.

Bernanke said the Fed in 2008 became aware of the first issue, but not the second.

The tone of the hearing was not sharply confrontational, as Bernanke appeared on Capitol Hill for a scheduled question-and-answer session on the economy. He also answered questions about monetary and fiscal policy, urging Congress to avoid a "fiscal cliff" of tax breaks that expire together at year end.

But Senators from both parties questioned Bernanke about what the Fed knew and what it has done regarding LIBOR.

"Seems like somebody dropped the ball," said Sen. David Vitter (R) of Louisiana. He cited the fact that "we're four years later and we don't know" whether three US banks that also participate in setting LIBOR were guilty of Barclays'-style misreporting their cost of borrowing from other banks.

"Knowledge of this occurred [at the Fed] in 2008," said Senator Vitter, yet the matter is still unresolved. "Am I missing something?"

"Only that ... I think the responsibility of the New York Fed was to make sure that appropriate authorities had the information, which is what they did," Bernanke responded.

The Fed, including its regional branch in New York, is tasked with regulating banks for their "safety and soundness," Bernanke explained, but not with pursuing the kind of infractions at issue in the interest rate case. He said the Federal Reserve Bank of New York passed information along to authorities including the Justice Department and Commodity Futures Trading Commission.

Bernanke stressed that the New York Fed offered recommendations to British officials on how to improve the LIBOR process.

He outlined two paths forward: Taking steps to ensure greater credibility within the existing LIBOR system, or replacing it with another benchmark based on observed transactions in the marketplace.

The Fed Chairman told lawmakers that consumers such as mortgage borrowers may have benefited from LIBOR manipulation in 2008, because the misreporting took interest rates in a downward direction. But he said manipulating the rate is "unacceptable behavior."

In Barclays' case, some of the alleged manipulation dates as far back as 2005 and 2006, prior to the financial crisis. In one 2006 email, a Barclays trader told a Barclays LIBOR submitter, "Would really appreciate any help," after explaining that "we have an unbelievably large set on Monday.... We need a really low 3m [three-month] fix, it could potentially cost a fortune."

The LIBOR scandal has become the latest blow to public trust in the financial industry, which has taken numerous other hits since 2008.

The credibility of regulators is also at stake.

On Tuesday, Bernanke's counterpart in Britain also made a public appearance talking about LIBOR. Bank of England chief Mervyn King dismissed accusations of negligence on LIBOR. He said he only found out about the malpractice two weeks ago.

Testifying before members of Parliament, Mr. King was questioned about a 2008 email sent by Timothy Geithner, then president of the New York Fed, with recommendations to enhance LIBOR's credibility. King said the Fed did not raise any evidence of wrongdoing.

In emails released by the Bank of England, Geithner's proposals, dated May 27, 2008, included a section on how to eliminate the incentive to misreport banks' lending rates.

The Wall Street Journal, in an editorial Tuesday, argued along a similar line. Quoting a June 2008 communication from Mr. Geithner to King, the paper said the memo's tempered language belied current "Fed spin" that US regulators were pressing hard for LIBOR reform.

Last week, 12 Democratic Senators sent a letter to Attorney General Eric Holder, Mr. Geithner (now Treasury secretary), and members of the US Financial Stability Oversight Council, appealing for both reform and pursuit of wrongdoers.

"We urge you to help restore some of that confidence [in the financial system] by conducting prompt and thorough investigations, evaluating the facts, taking appropriate actions against any wrongdoers, and fixing this process so that breaches of confidence like this do not happen again," the letter said.

Material from wire services was used in this story.