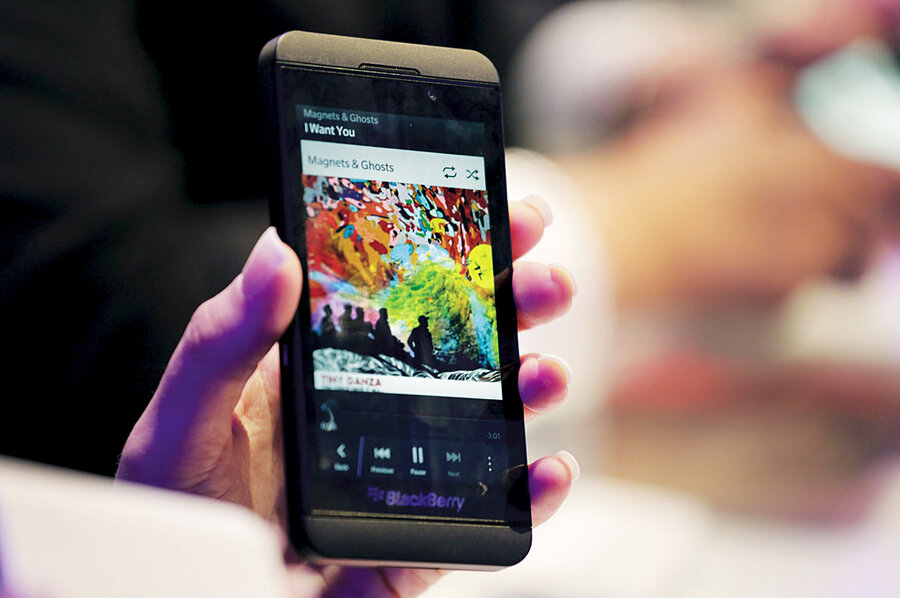

Blackberry's down (way down) but not quite out

Loading...

On Friday, Blackberry dropped the bomb that everyone knew was coming, but were waiting for the extent of the damage. It seems the Canadian company cannot catch a break.

In the third quarter of 2013, Blackberry posted a $4.4 billion loss, which includes a write-down on the current inventory of $1.6 billion. In terms of sales, this quarter only yielded $1.2 billion in revenue, down 24 percent from last quarter, and 40 percent of that revenue came from the 1.9 million smart phones sold, down from 3.7 million last quarter.

Though things seem pretty dire for the tech company that ushered in the era of BBM’s and still counts POTUS as a customer (the President uses Blackberry for security reasons, but has expressed desire to switch to the iPhone), the company is not down and out yet. Along with the sales loss announcement, Blackberry laid out its plans to bounce back.

The most prevalent plan is a five-year deal with electronics manufacturer Foxconn. The plan would relinquish much of Blackberry’s inventory control to Foxconn. “Essentially, it sounds much more like BlackBerry is making Foxconn a licensee with more or less full control over its smartphone division, while it continues to work on services and software in-house,” writes Darrell Etherington of TechCrunch. “It could be a good way to offload the risk and responsibility of handset production while still selling to its remaining market strongholds.”

In a statement, Blackberry interim CEO John Chen says recent leadership shuffling and an increased focus on software and social media over devices will be key to turning the company around. The smart phone side of Blackberry won’t be going away however – Mr. Chen says the focus will now be capturing emerging markets such as “Indonesia and other fast-growing markets in early 2014.”

Let’s back up for a second – how did Blackberry get here? In 2009, it was named one of the fastest growing companies.

Time’s Sam Gustin says that Blackberry’s biggest failure was not their device, but that they didn’t anticipate that smart phone growth would stem from consumers – not business people.

“BlackBerry was completely blindsided by the emergence of the 'app economy,' which drove massive adoption of iPhone and Android-based devices,” he writes. “BlackBerry failed to learn that smartphones would evolve beyond mere communication devices to become full-fledged mobile entertainment hubs.”

Chen has an uphill battle ahead of him, but a massive shake up may be exactly what Blackberry needs after reporting massive losses.