The right way to fail in cleantech

Loading...

The transition to cleantech – some would call it a revolution – inevitably entails change, which implies risk. In turn, this implies that some things will fail.

We’ve already seen more than a few failures, and we’ll no doubt see many more.

As long as the successes outweigh the failures, that’s all that ultimately matters. Indeed, sometimes failure actually enables later successes.

As Thomas Edison has been quoted, “I have not failed. I’ve just found 10,000 ways that won’t work.” And, then finally — ta-da! — he discovered an approach that worked for the incandescent lightbulb, thereby changing the world forever.

But, sometimes failures can get in the way of success – particularly, if they’re the wrong kind of failures.

Edison failed quickly, cheaply and – perhaps most importantly – invisibly. Some of cleantech’s most painful failures have been anything but.

Consider two prominent examples: Solyndra and A123. The technologies being developed by the two companies actually work well enough, but couldn’t compete effectively in the marketplace.

The management teams and the backers of these companies promised great things with premature hype in innumerable press releases. The companies blew through lots of capital – including substantial government funding.

Then, they fly off the cliff and go bust, and the media and blogosphere — much of which is adverse to cleantech — report their demises with barely-hidden Schadenfreude.

OK, so it’s not like a mass shooting spree: no-one got killed in these failures. But equity holders lost every dollar, creditors took a deep haircut, taxpayer money was wasted, and pretty much everyone active in the cleantech sector gets tainted by extension.

As bad as economic failures, worse is when technologies fail because they simply don’t work.

The earliest windfarms of the mid-1980s in California became an eyesore of inoperative machinery, because the turbines were deployed in mass quantity before many engineering and manufacturing problems had been fully resolved. In the wake of this debacle, the U.S. wind industry took more than a decade to recover. By the time wind energy had regained credibility in America, European wind turbine manufacturers dominated the market.

These visions returned to me during a recent trip to Oahu, where my lodging provided me an ongoing view of the Kahuku windfarm standing idle in the face of a week of strong trade-winds. My first thought was a serial failure of the turbines – a relatively new 2.5 megawatt design fromClipper, a manufacturer with known technical issues.

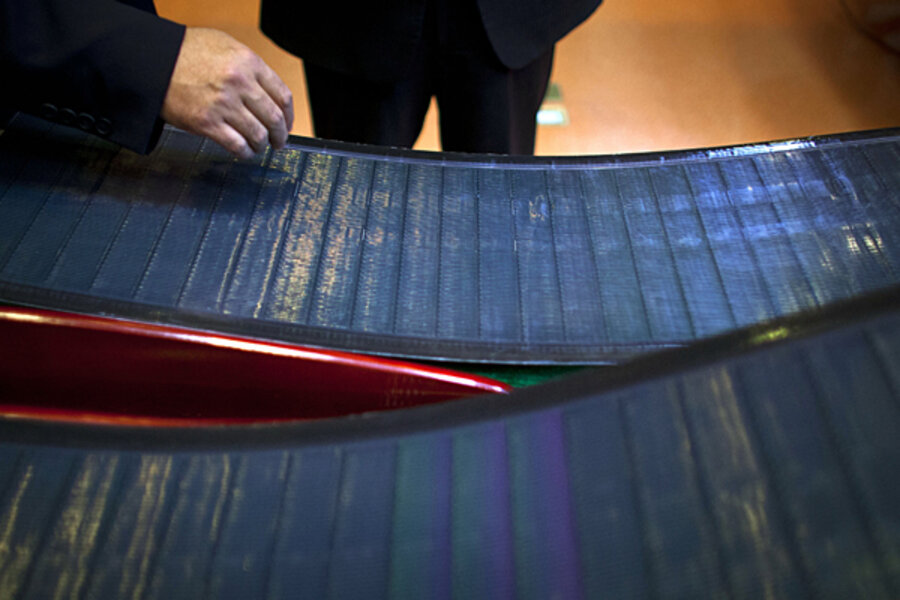

However, as this report indicates, the root cause of the shutdown was unrelated to the wind turbines, but rather some problem with a set of grid-scale batteries being developed by Xtreme Power, and being piloted at the site to test the ability of such batteries to buffer the variable output of a windfarm. The pilot deployment had caused not one but three fires somehow involving the interconnection between the windfarm and the Hawaiian Electric grid, thus causing the windfarm to be idled while sorting out the battery issues.

Why weren’t these batteries tested in smaller scale and in a less obvious setting? Not only is the image of Xtreme Power (and grid-scale energy storage) being adversely affected, the long shutdown of Kahuku is dampening enthusiasm for wind energy in Hawaii.

It is these kinds of visible economic or technical failures that give the cleantech sector a black eye. The bad reputation diminishes civic goodwill, support for favorable public policies, and appetite for private capital to be allocated to the sector.

Unlike Edison’s failures, largely unnoticed by the rest of the world while he returned again and again to the drawing board, visible cleantech failures are distinctly unhelpful.

Such episodes are very painful for those of us on the sidelines working humbly to maintain forward progress in spite of the setbacks that inevitably occur in this long and challenging cleantech transition.

In the venture capital world, it is axiomatic to fail fast, so as to minimize capital at risk. For cleantech, this adage should be modified: fail fast, and stealthy.

The implication: cleantech ventures — and their investors — are well-advised to maintain a low profile for a long time, until their success is reasonably assured. It’s far better to underpromise and overdeliver than vice versa. Humility is essential. Premature bragging is very easy to eviscerate by the pundits hungry for a tussle when things later go bad.

The more that cleantech entrepreneurs can avoid shooting themselves in the foot when the spotlight is on them — first and foremost, by not encouraging the spotlight to be shined upon them — the better.