Turkey is ready to help lead the new global economy

Loading...

First the Taksim Square protests. Now the coming Fed “taper” that will raise global interest rates and jam growth in the emerging economies such as Turkey.

Many argue that much of Turkey’s growth in recent years, like that of Indonesia, India, or Brazil, has been fueled by low interest rates that have resulted from the expansive monetary policies of the US Federal Reserve – in essence, the world’s central bank.

Anticipating an economic recovery in the United States, the Fed has announced that it will “taper” the quantity of money it is pumping into the economy, causing interest rates to rise globally. How will this impact Turkey?

I put this question to Ali Babacan, Turkey’s suave and highly competent deputy prime minister for the economy.

There is good and bad in the mix. In the very short term, says Mr. Babacan, asset prices will fall as investors build in expectations of less money floating around. Then rates at some point will actually rise, forcing Turkey and other “emerging growth economies” with current account deficits to rein them in.

Beyond this, those countries that have not engaged in structural change during the boom years will now find it much harder to do so in a slower growth environment.

Fortunately, this is not the case for Turkey. Forced by its own financial crisis in 2001-2002 to get its debt and banking system in order – as well as put social benefits on a sustainable long-run path – Turkey is in good shape on this score. “These fundamental pillars of the economy are sound,” says Babacan.

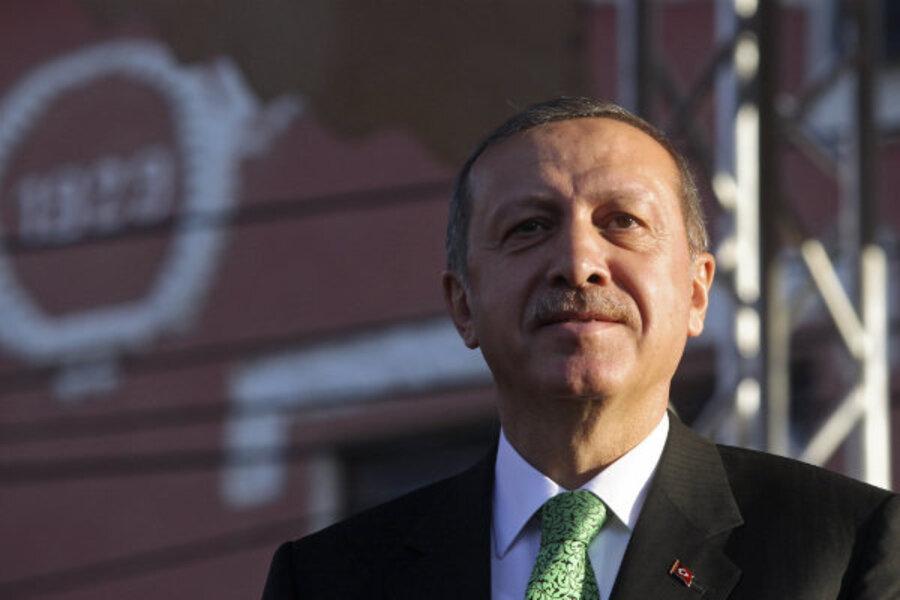

This echoed what Prime Minister Recep Tayyip Erdogan told me in Berlin last March, when he noted that, paradoxically, Turkey has done a better job meeting the economic entry criteria to the European Union than many states that are already members.

In Europe in general, Mr. Erdogan noted, the average annual budget deficit has grown to 4.5 percent of GDP, while in Turkey it has fallen to 1.7 percent.

Overall, long-term debt in Europe amounted last year to 85 percent of GDP, while in Turkey it was only 37 percent. Turkish foreign currency reserves top $100 billion, and Turkey has paid back all of its loans to the International Monetary Fund.

For Babacan, the adjustments to the “new normal” ahead will do nothing to derail the rise of the emerging economies as ever larger players on the world scene. Already, half of global product is created by the emerging economies. Even as the pace of growth may cool, they will still far outpace the 2 percent-range growth rates of the advanced economies when they recover. This means that over time, even if the emerging economies continue to grow at a solid-but-not-hot rate of 4 to 7 percent per year, they will surpass the established powers.

One key insight offered by Babacan – who will guide Turkey’s chairmanship of the G20 nations in 2015 – is this: It has become clear that the G20, as the mechanism for adjusting this shifting global economic order, is an essential coordinating body both during times of crisis and recovery. Just as in 2008-2009, when the G20 was critical in staving off world economic depression by coordinating global stimulus policies, so too it is now critical to ensuring that letting up on the stimulus gas pedal is calibrated so as not to damage global growth prospects.

To make the G20 more effective in the future, Babacan suggested that it is high time to establish a “permanent secretariat” to enable continuity and follow-through between annual summits.

As for the post-Taksim-protests period in Turkey, the deputy prime minister was at pains to argue that the AKP government (the ruling Justice and Development Party) has heard loud and clear those constituencies who “felt excluded.” “The government of Turkey is the government of all the people,” he said, “not just those who vote for it.”

In this, he echoed both President Abdullah Gul and Prime Minister Ergodan, who in recent weeks have outlined a “pluralistic and inclusive” agenda that is part and parcel of a revived effort to join the EU.

So far, because the Turkish government has been responsive, the social unrest around Taksim Square seems to have strengthened democracy, not weakened it. The next test for democracy will be how it weathers “the new normal” of slower growth. Because Turkey’s fundamentals are in order, its prospects seem quite positive.

Nathan Gardels is editor-in-chief of the Global Viewpoint Network of Tribune Content Agency. His latest book, with co-author Nicolas Berggruen, is “Intelligent Governance for the 21st Century: A Middle Way Between West and East.”

© 2013 Global Viewpoint Network, Distributed by Tribune Content Agency, LLC. Hosted online by The Christian Science Monitor.