Inequality's secret engine: friends and family

Loading...

If you’re a single mother, friends and family likely play a crucial role in keeping your head above water – babysitting in a pinch, giving rides to and from school and appointments, and helping out with expenses when money gets tight.

But that very safety net may be holding you back in other ways.

Millions of Americans rely on a network of friends and family for support, and the financial aspect of that support is especially vital. What’s more, it can reinforce existing financial advantages and disadvantages and entrenching class divisions, according to a new report out Wednesday from Pew Charitable Trusts.

“As kids grow up and begin forming their own households, extended family—parents, grandparents, siblings, and others—and friends continue to play an important role in their financial lives,” the Pew report reads. “but this element of household balance sheets and of the financial system broadly is largely hidden from public view and poorly understood.”

Researchers looked at how “kinship networks” help in ensuring financial security, and found that such relationships are vital across all income levels, though in different ways. For example, lower income households, or those with an annual income of $45,000 or less, receive money from friends or family more frequently than their higher-earning counterparts.

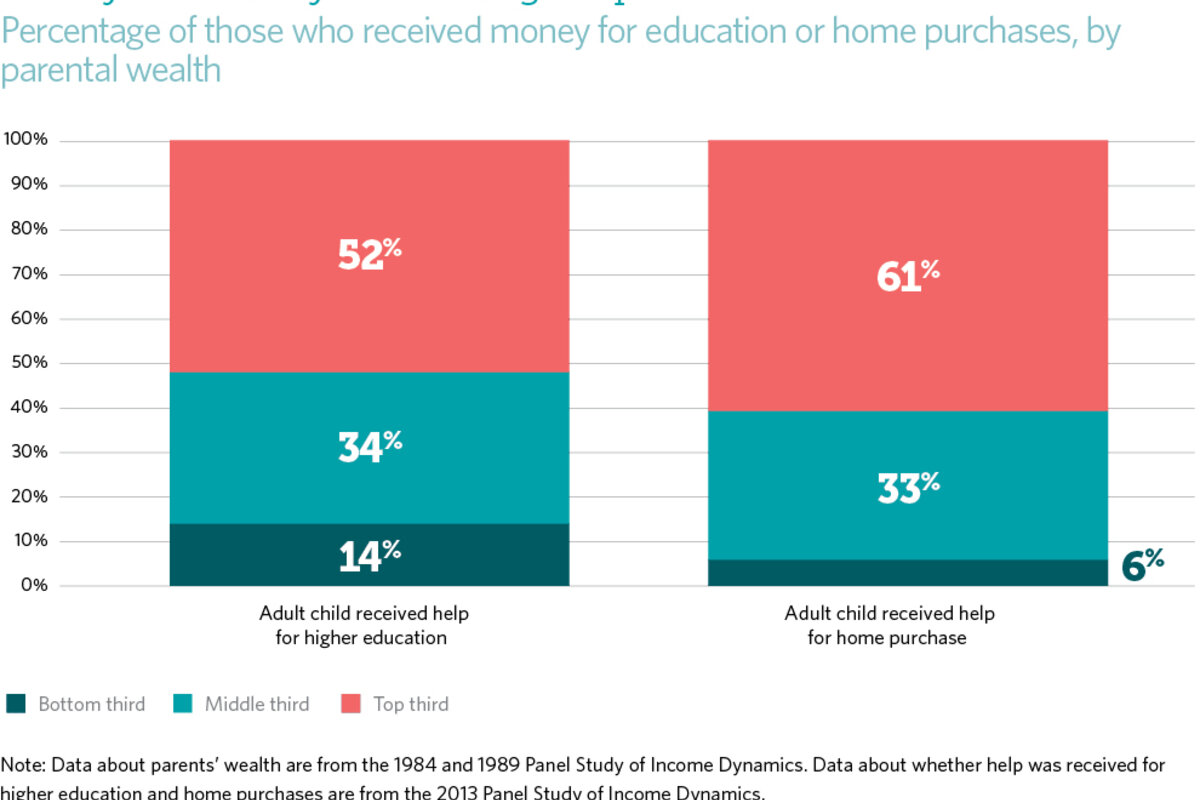

However, high-income households are far more likely to receive the sorts of monetary transfers that will help them get – and stay – ahead. Over half of adult children who received help paying for their education are from the top third of America's wealthiest households, for instance. Sixty-two percent of those who put money toward a down payment on a home are from that group.

Meanwhile, just 14 percent who received help for higher education and 6 percent who received help for home purchases were raised in the least wealthy families.

“Mobility-enhancing investments, such as assistance with tuition and down payments on homes, are more often available to and benefit those who already have existing financial advantages,” the Pew report reads.

Inheritance is somewhat of a rarity among American families, something just 15 percent of households have received. But those who have are overwhelmingly rich, and white.

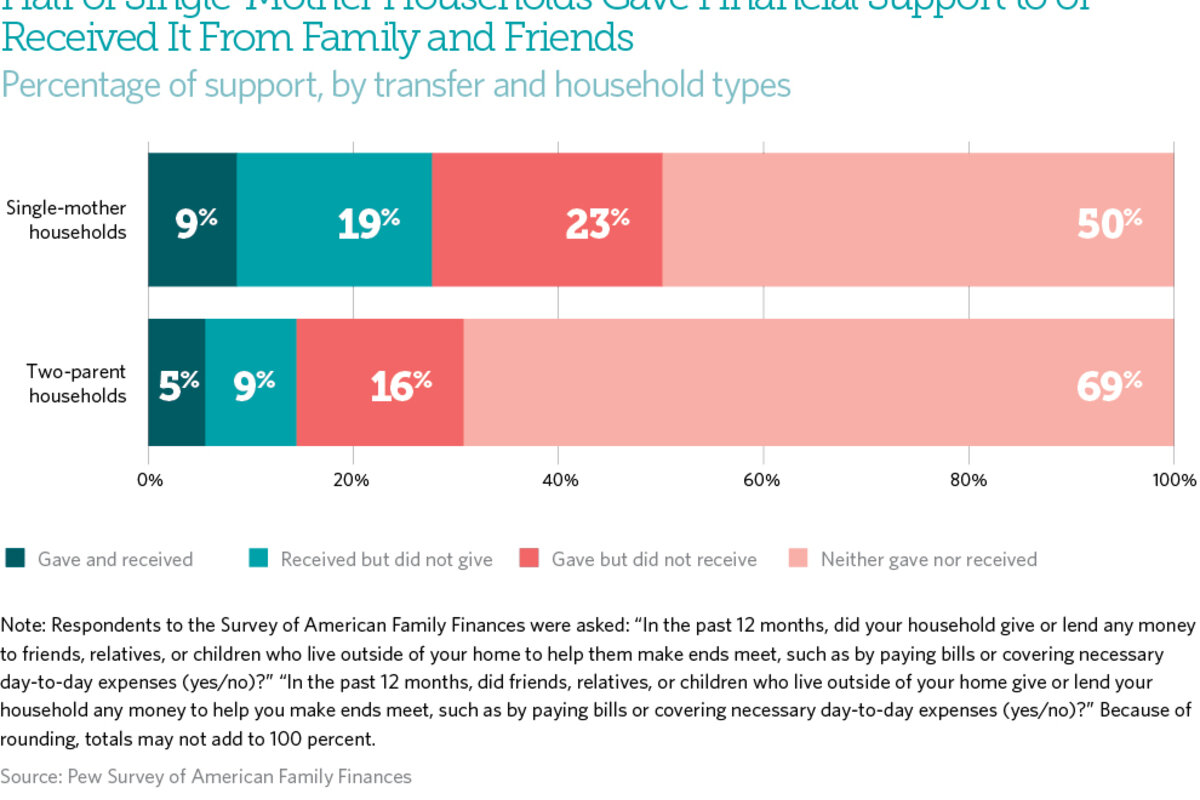

Still, the standout group, the one involved with these types of financial transactions more often than any other, is single mothers, even after accounting for other factors including race, age, and education. Half of single moms in the study reported giving or receiving money within the past year. Of those who gave or money, however, three quarters said that doing so was a burden.

“They are very tethered to their social networks,” says Diana Elliot, research manager of Pew Charitable Trusts’ financial security and mobility project. “They’re younger and more financially fragile, and they rely on [friends and family] to fill in the gaps and help with childcare.”

As a result, the report says, they may feel extra pressure to give money even when it’s difficult to do so. “That single mothers gave anyway may indicate what some scholars call ‘negative social capital,’ it reads. “In other words that the network of family and friends that single mothers depend upon for assistance may also ask so much of them in return that they bear emotional and financial costs.”

Pew offers no specific recommendations, but Ms. Elliot says an understanding of how money moves between family members could be a big help in drafting policies to tackle wealth inequality and break down barriers to economic mobility. Policymakers grapple constantly with questions of how to make homeownership and education, two direct paths to economic advancement, more accessible to wider swaths of Americans, for example.

Another potential route may be encouraging lower-income Americans to build up emergency savings so they don’t have to lean so heavily on their social networks when unexpected expenses pop up. In December of last year, Representative Jose Serrano (D-NY) introduced a bill that would offer tax credits to low and middle income households that put their tax refunds into savings accounts, to better handle the financial blow of an unexpected medical bill or car payment. The model has been adopted in a handful of US cities.

"Far too many Americans are living on the edge of financial disaster, and just the slightest emergency can tip them over the edge. This bill will help address these problems.” Mr. Serrano said upon introducing the bill to Congress.