Do Republicans want to cut taxes on the rich and raise them on the rest?

Loading...

Of all the curious rhetoric floating around both Washington and the campaign trail, the strangest may be the demand of many Republicans that Congress raise taxes for low-income working households even as it cuts taxes for the wealthy. The left has, not surprisingly, gleefully leapt on the issue. And, honestly, it seems like terrible politics for the GOP.

But this idea is hardly new. It is a key element of various forms of consumption taxes such as the National Retail Sales Tax (including the wildly misnamed FAIR tax). It is also favored among those on the right who want to close “loopholes” to force low- and moderate-income households to pay some income tax even as they cut rates across the board—a design almost certain to favor high-income taxpayers.

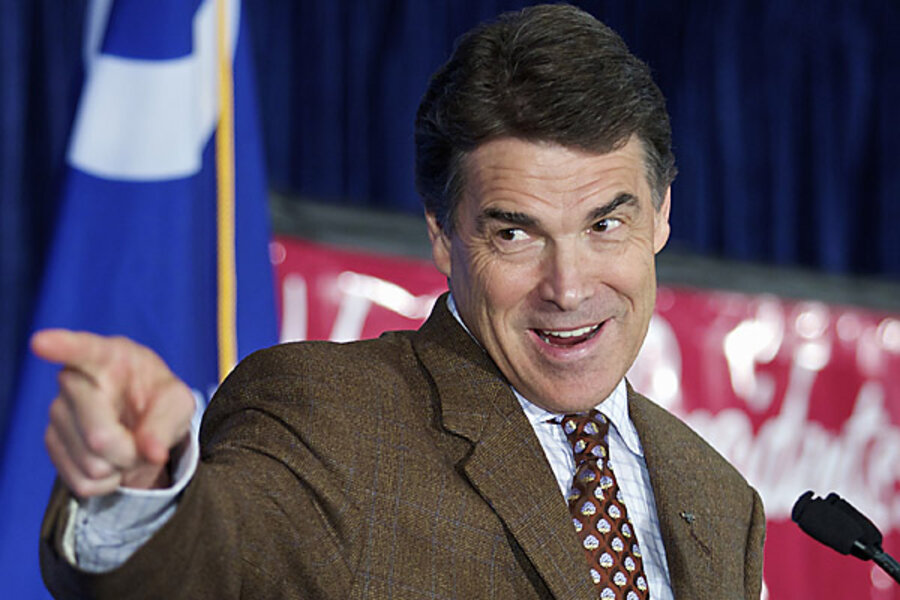

Texas governor and GOP presidential hopeful Rick Perry supports the FAIR tax (or at least did last year when he wrote his manifesto Fed Up). This levy would repeal nearly all federal taxes (including the income tax and the payroll tax) and replace them with a single-rate national sales tax on the purchase of all goods and services. FAIR tax backers set this rate at 23 percent but the Tax Policy Center’s Bill Gale and others have concluded that the rate would have to exceed 30 percent if the scheme is to raise as much money as current law.

To try to get a sense of what such a levy would do to the tax burden across incomes, the Tax Policy Center analyzed a generic consumption tax designed to replace most federal taxes. In, um, fairness, it is important to note that TPC did not review the actual FAIR tax but rather a stylized Value Added Tax –type consumption tax. But any broad-based consumption tax will generate roughly the same pattern.

Still, the results are dramatic. On average, such a levy would raise the share of taxes paid for all but the highest-income households, who would pay far less than they do today. A consumption tax without any rebate to protect low-income people (the red bar in the graph) would be extremely regressive. In other words, the more you make, the lower your tax burden, and the less you make, the higher–a mirror image of today’s moderately progressive tax system.

The reason is simple: A consumption levy would not tax income from saving, and low- and moderate-income people save a lot less than the rich. Thus, if Congress taxes consumption, those down the economic food chain will inevitably pay more in taxes. One way Congress can address the problem is with a rebate—effectively exempting thousands of dollars of spending from tax (the exact amount is tied to the poverty level so it rises as income falls).

As the blue bars in the graph show, such a rebate would not completely fix the problem. Low- and moderate-income families would still pay more on average than they do today. But they’d pay a much smaller share than if there was no rebate.

There is a funny thing about the rebate, though (called a prebate in the FAIR tax). It would end up exempting a lot of low-income households from tax—recreating exactly the problem Perry and others complain about. And even with a rebate, the highest income 5 percent of households would still enjoy a major tax cut even as others pay more. Such a consumption tax would reduce the tax burden for the top 1 percent (who make an average of $1.6 million per year) by a stunning 40 percent.

Of course, tax systems are about more than fairness. Efficiency and the effect on the overall economy matter. But I’m not sure I’d want to run for president on a promise to cut the tax burden on millionaires by 40 percent even as I’d raise taxes for nearly everybody else. Forget class warfare. This is more like the charge of the Light Brigade.