Paying for college: Six tips for navigating financial aid options

Loading...

High school juniors, soon-to-be seniors: As you’re headed into a year of varsity letters, last hurrahs and anticipation for the new beginning that’s now just around the corner, don’t forget about college applications and financial aid forms.

You don’t have to go through the college application cycle alone. Your high school’s counselors and college financial aid advisors are there to help. We talked with several and asked them their best advice for maximizing financial aid and staying calm about college planning. Here are six little-known tips to save you time and money.

1. You can pay tuition in installments

Looking at a college’s price tag can be enough to induce a minor heart attack. But you aren’t expected to pay for the entire year all at once, says Phil Trout, a college counselor at Minnetonka High School in Minnetonka, Minnesota.

“No college is ever going to ask [families] to write a check for $50,000,” Trout says.

Schools typically send a bill each semester, but many also offer monthly payment plans. Monthly tuition payments often are easier for families to budget for because most other household costs, like mortgages and cell phone plans, are due monthly, he says.

» More: How to pay for college

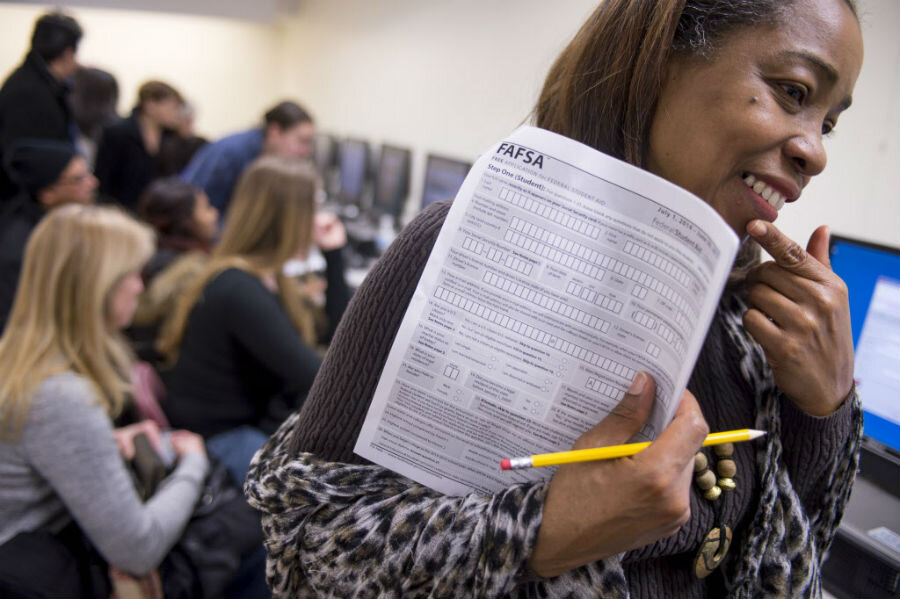

2. Filling out the FAFSA will be slightly less of a headache

Filling out the Free Application for Federal Student Aid will be slightly different this year than in years past. You can start filling out the FAFSA in October 2016 for the 2017-18 school year. Previously, the earliest you could fill it out was January of the year you’d start college.

Also, this year you can use your family’s 2015 tax information to complete the FAFSA for the 2017-18 school year. Until this year, families had to use tax information from the previous year when filling out the FAFSA for the upcoming school year. That meant they either would have to wait until April to complete the FAFSA, file their tax return early or estimate their tax information on the form.

The changes are expected to make applying for financial aid a more seamless experience for college-bound students and their families, says Kent Rinehart, dean of admission at Marist College in Poughkeepsie, New York. “They should be able to get a more accurate picture of what their finances are, as well as what type of financial aid will be available to them,” he says.

3. There’s a financial aid form most people don’t know about

You probably already know about the FAFSA, but around 300 private colleges require students to submit the CSS Profile in addition to the FAFSA to be considered for school-based scholarships. It costs $25 to submit the unsung financial aid form, plus $16 for each copy if you need to send it to more than one school.

“Many schools are sticklers about it,” says Bianca Martinez, a college advisor with the nonprofit College Advising Corps. “If you don’t submit it on time, they deny you institutional funding.”

4. You often have to opt in to school-based scholarships

Just because you apply to a college doesn’t mean you’re automatically in the running to receive an institutional scholarship, says Marie Bigham, director of college counseling at Isidore Newman School in New Orleans.

Look for a check box on the application that indicates you want to be considered for a scholarship, and make sure you’re not missing a separate scholarship application altogether.

Keep an eye on deadlines, too. “Some schools have earlier [application] deadlines if the student wants to be included in the scholarship pool,” Bigham says. For example, last year’s University of Southern California application deadline was Jan. 15, 2016. But for students who wanted to be considered for merit scholarships, the deadline was Dec. 1, 2015.

5. Paying for financial aid help isn’t worth it

No matter how confusing filling out the FAFSA or CSS Profile is, you don’t need to pay a company to help you, Rinehart says. Plenty of free resources are available that will get you to the same result.

“If you’re applying for financial aid, you probably want to save as much money as possible,” he says.

When applying for financial aid, start by talking with your high school counselor. If you still have questions, call the financial aid office at one of the colleges where you’re applying. Finally, look for a financial aid completion event near you — many schools and local organizations host free workshops with experts on hand to answer your questions as you fill out the FAFSA.

6. Talking about family finances is important

If there’s one thing every college counselor agrees on, it’s this: Students and their parents need to talk about money early in the college application process. You should have an idea of how much your family can afford to pay so you can set realistic expectations about the colleges you’re considering, Rinehart says.

Plus, you need to know your family’s financial situation so you can help your college counselor help you, Martinez says.

If money is a touchy subject in your family, be thoughtful about how you approach the subject. “Those lines of communication have to happen,” Martinez says. “Find a time when they’re in a good mood and have a heart to heart with them.”

Teddy Nykiel is a staff writer at NerdWallet, a personal finance website. Email:teddy@nerdwallet.com. Twitter: @teddynykiel.

This article first appeared at NerdWallet.