Taxes: Doing it yourself is easier than you think

Loading...

When I was a 21-year-old newlywed, I couldn’t bear the thought of paying someone to do our simple taxes. So I went to the library, got the forms and did them myself. That was back in the days when you did taxes by hand using an adding machine. Today, with the many free and low-cost software options available to guide you through the process, doing your own taxes is a great idea for many people.

Of course many taxpayers are nervous about doing their taxes wrong and avoid it completely. But there’s no reason to be afraid. Over the years I continued to do our taxes and other family members’ taxes too. Sometimes I made mistakes, and when I did, I would get a letter from the Internal Revenue Service gently pointing out my mistake and either asking me for more money or sending me a bigger refund.

It’s not the end of the world if you make a mistake, so long as it’s a mistake made in good faith, rather than intentional fraud. The IRS simply lets you know what you did wrong and how much you owe or will receive. A small, honest mistake doesn’t generate an audit.

Key considerations

If you’ve never done your own taxes before, now is a great time to learn. It will help you understand what you pay in taxes and why. Even if you end up paying someone else to do them, the exercise of learning how to do your taxes will make you a better consumer when it comes to negotiating costs when working with a professional.

If you plan to do your own taxes, here are the key components you should consider:

Tax-prep software

If you need to buy software, you have several products to choose from, so make sure you do your research to determine which one is best for you.

If the amount you make (your adjusted gross income) is below certain amounts, you can access free tax software like FreeTaxUSA or other free versions of tax-prep software such as TurboTax, H&R Block and Tax Act. Additionally, depending on your age and income (for 2015 taxes, the income limit is generally $54,000), you may be able to use VITA, TCE or AARP free tax preparation, which is usually offered at the library or community center in your town. Of course, that would defeat your goal of doing your taxes yourself, but at least you wouldn’t have to pay to have them done.

How-to instructions

Most paid versions of tax-prep software are full of great information and education that will guide you step by step through the process. If you have additional questions or don’t understand something, the IRS website is a great resource. Be sure to go to the government’s site, www.irs.gov, not www.irs.com. You can also call the IRS directly to get help. You might have to wait on hold for a while, but the people who answer the phone are usually very helpful and friendly.

Reducing your taxes

It’s legal and acceptable to try to minimize how much you pay in taxes, so you want to educate yourself to be sure you get all the deductions, reductions and credits you are eligible for. The IRS Tax Code 25.1.1.2.4 explains the difference between avoidance and evasion of taxes: “Avoidance of tax is not a criminal offense. Taxpayers have the right to reduce, avoid, or minimize their taxes by legitimate means. One who avoids tax does not conceal or misrepresent, but shapes and preplans events to reduce or eliminate tax liability within the parameters of the law.” On the other hand, tax evasion, which is a criminal offense, occurs when taxpayers deliberately act to “evade or defeat a tax, or payment of tax.”

When you use tax-prep software, you’ll be asked questions that will help you pay the right amount of taxes. You can also search online for information about the kinds of deductions and benefits you are eligible for in your particular situation.

Keeping records

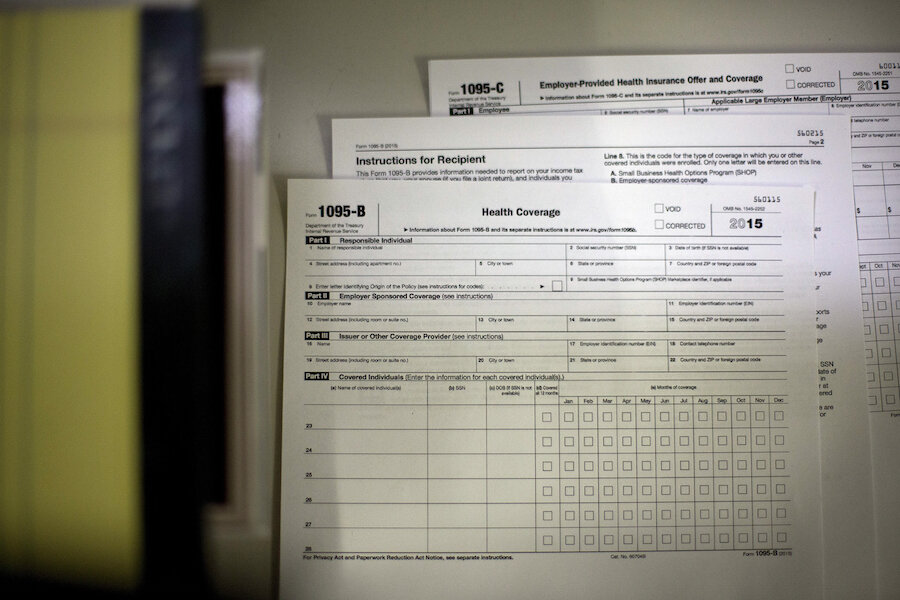

Be sure to keep all the documentation and forms you could possibly need when doing your own taxes. If you don’t have a printer at home, save the electronic PDFs of your tax forms and worksheets to a thumb drive so you can take it somewhere to print all the forms.

Also make sure to keep the CD or link to the tax-prep software you used. (I have always bought my software on a CD, which I save, rather than downloading, in case I have to look back at a prior year’s taxes and need a particular year of the software application.) If you get a new computer, you could lose the application and your files.

Keep all of your records somewhere safe and accessible because you could need them when you do taxes for future years, if you want to apply for a loan or for other reasons.

The bottom line

If you can become comfortable doing your own taxes, it can save you money in preparation fees and make you feel more in control of your money. But if you need help, you can always turn to a qualified professional. Just don’t wait until the last second.

Kathryn Hauer is a certified financial planner and fee-only investment advisor with Wilson David Investment Advisors in Aiken, South Carolina.

Learn more about Kathryn on NerdWallet’s Ask an Advisor

This article also appears on Nasdaq and NerdWallet.