Gay marriage: a tax guide for newly-wedded couples

Loading...

With 36 states now recognizing same-sex marriage, many newly wedded gay and lesbian couples will be filing joint tax returns for the first time this year. For some, it could mean being bumped to a higher tax bracket or getting a bigger refund. For those who live or work in states that don’t recognize gay marriage, it could mean filling out multiple returns.

“There’s a lot of good reasons for getting married. Taxes aren’t one of them,” says Tina Salandra, a certified public accountant and principal at Numerical, a New York firm that specializes in tax counseling for same-sex couples. She notes that same-sex couples are often surprised by the extra costs of filing as married.

Don’t get caught off guard this tax season by higher tax rates or benefits you didn’t know were available to you. The sooner you know what to expect, the quicker you can get help from a tax expert if you need it as well as get your deductions and credits.

Here’s a look at what this year’s tax season might mean for you and your spouse:

A lot depends on where you live

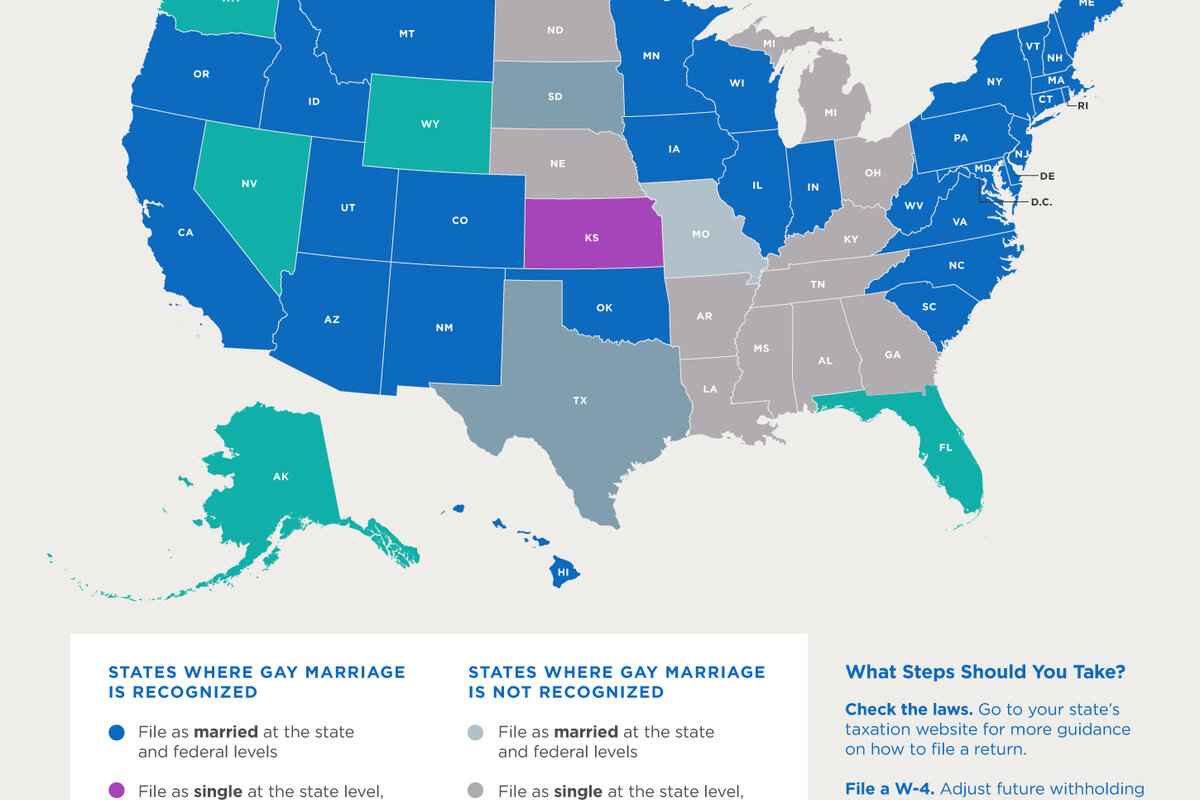

No matter what state you’re living in, for the federal level you’ll have to file as married either separately or jointly. You’ll also have to file as married at the state level if you live in a state that recognizes gay marriage (with the exception of Kansas). But if the state you live or work in does not recognize same-sex marriage, you’ll likely have to file as single on your return for that state (with the exception of Missouri). Check your state’s taxation website for more guidance on how to file in these situations.

You may owe more in taxes

Since married gay and lesbian couples earn more on average than their straight peers, according to a 2012 Experian study, they’re more likely to be bumped into a higher tax bracket when filing as married, whether it’s a separate or joint return. This is called the marriage penalty — and for higher-earning couples, it’s often unavoidable.

“Straight people have been plagued with this for years, whether they realized it or not,” says Salandra, noting that many end up paying thousands more in taxes as a result.

If you find out that you’ll owe more in taxes this year because of your married status, fill out a W-4 with your employer to adjust your future withholding and prepare for the next tax season.

You may save on taxes

Filing as married doesn’t always come at a higher cost. If you and your spouse are lower earners, or if one of you is a stay-at-home parent and the other works, you’ll likely get a bigger refund than you would if you were filing as single. As a married couple, you can also transfer property and money to each other without triggering the gift tax or estate tax, and this could save you a lot in the long run.

Amending past returns may save you money

If you got married before the Internal Revenue Service announced in 2013 that it would start recognizing all same-sex marriages for federal tax purposes, you can still amend previous returns. Fill out a Form 843 to get a refund on gift taxes and estate taxes and a Form 1040X to amend income tax returns.

“Taxpayers are under no obligation to file amended returns, but a review is worthwhile to see if a different filing status might result in a refund of taxes paid,” says Portia Rose, a CPA at Marcum LLP, a top national accounting and advisory firm that offers specialized tax services for LGBT couples and other nontraditional families.

If you’re unsure whether amending would save you money, ask a credentialed tax expert to help you weigh factors such as tax refunds on a partner’s health care, child tax credits and gift taxes. You can also do a free estimate of your amended return on the do-it-yourself tax site TurboTax.

For now, paying taxes for same-sex couples can be a headache, but Rose says things are quickly changing.

“I look forward to the time when every state in the union will recognize same-sex marriages and make our lives easier,” she says.

Where to find help

Here are a few organizations that offer free assistance to same-sex spouses trying to figure out taxes this year:

PridePlanners – Search a database of tax professionals who can help you file returns in your state.

TurboTax – The DIY tax website provides a free estimate of how much you could save with an amended return.

Volunteer Income Tax Assistance – Search here for free tax counseling if you earn $53,000 or less a year.

Tax Counseling for the Elderly – Senior citizens filing returns can search for one-on-one support here.

Infographic by Sydney Buffman.