Too much too soon? Hong Kong may be experiencing housing bubble

Loading...

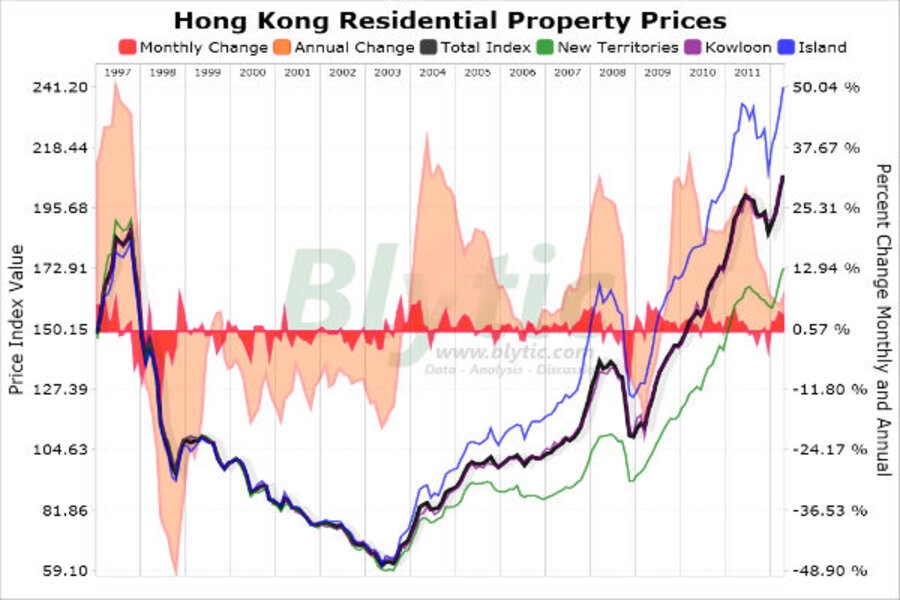

Recently, the University of Hong Kong released their Hong Kong Residential Real Estate Series (HKU-REIS) indicating that, in April, the price of residential properties increased a notable 3.23% since March and climbed 7.11% above the level seen in April 2011.

It appears that after a notable pullback in late-2011 prices are totally soaring with all measures rising notably on the month.

The HKU-REIS is a set of property price indices constructed monthly using a “modified” repeat-sale methodology similar to that of the S&P/Case-Shiller indices yet suited to the Hong Kong property market.