Home prices continue to slump into double-dip

Loading...

Note... be sure to bookmark the overall S&P/Case-Shiller Dashboard or the Scary Housing Dashboard of the weakest markets for a real-time view of all the markets tracked by S&P.

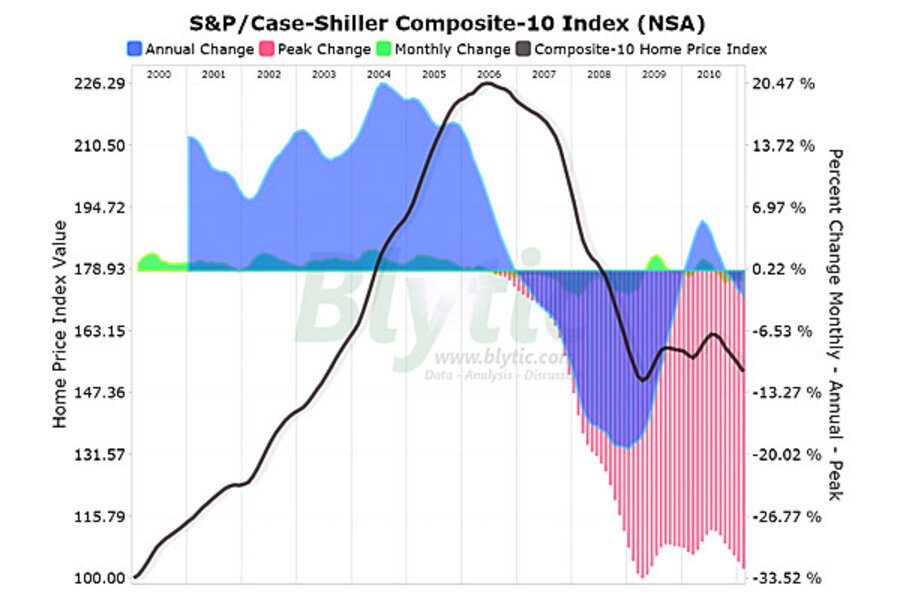

Today’s release of the S&P/Case-Shiller (CSI) home price indices for February reported that the non-seasonally adjusted Composite-10 price index declined a notable 1.11% since January indicating that housing is continuing slump into a double-dip.

The latest CSI data clearly indicates that the price trends are continuing to slump and, as I recently pointed out, the more timely and less distorted Radar Logic RPX data is continuing to capture notable price weakness nationwide.

Further, both composite indices are now showing notable year-over-year declines, a weak sign indeed.

The 10-city composite index declined 2.65% as compared to February 2010 while the 20-city composite declined 3.33% over the same period.

Topping the list of regional peak decliners was Las Vegas at -58.14%, Phoenix at -55.67%, Miami at -50.71%, Detroit at -46.50% and Tampa at -46.08%.

Additionally, both of the broad composite indices show significant peak declines slumping -32.52% for the 10-city national index and -32.56% for the 20-city national index on a peak comparison basis.

To better visualize today’s results use Blytic.com to view the full release.

This chart shows the percent change to single family home prices given by the Case-Shiller Indices as compared to each metros respective price peak set between 2005 and 2007.

This chart shows the percent change to single family home prices given by the Case-Shiller Indices as on a year-over-year basis.

This chart shows the percent change to single family home prices given by the Case-Shiller Indices as on a month-to-month basis.

Additionally, in order to add some historical context to the perspective, I updated my “then and now” CSI charts that compare our current circumstances to the data seen during 90s housing decline.

To create these annual and normalized charts I simply aligned the CSI data from the last month of positive year-over-year gains for both the current decline and the 90s housing bust and plotted the data side-by-side.

The “peak” chart compares the percentage change, comparing monthly CSI values to the peak value seen just prior to the first declining month all the way through the downturn and the full recovery of home prices.

Add/view comments on this post.

--------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.