Bank lending big government style

Loading...

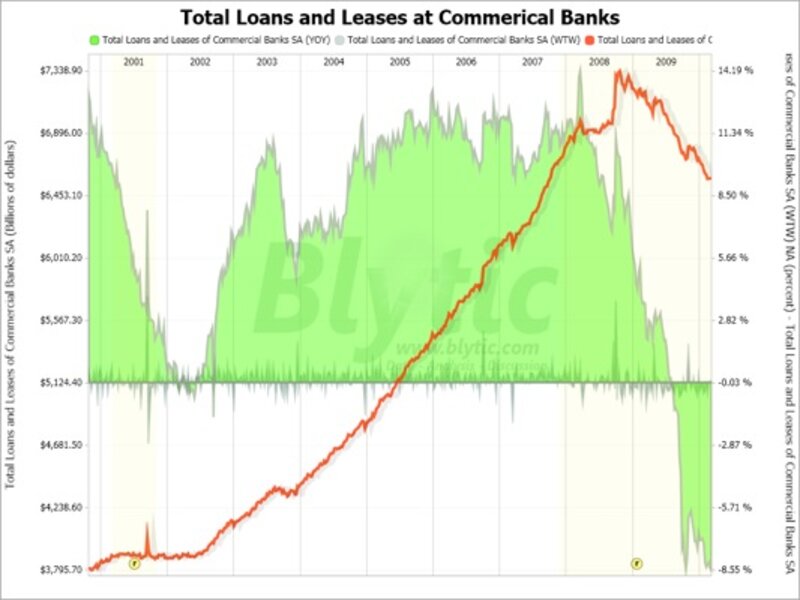

The latest weekly read of “Total loans and Leases of all Commercial Banks” indicates that banks are pulling back lending at the fastest pace on record with total loans and leases declining 8.55% on an annual basis.

U.S. government securities at all commercial banks, on the other hand, are booming increasing 13.45% on a year-over-year basis.

This likely underscores a fundamental quirk of today’s commercial lending environment.

High rates of delinquency and default on business and consumer loans are working to tighten direct commercial lending overall while government sponsored lending activities, such as is carried out through Fannie, Freddie, Ginnie, Sallie and FHA, work to prop specific lines of lending.

Commercial banks are, in a sense, refusing to generally lend unless they have a government guarantee.

Further, with the latest aggressive round of government mortgage mitigation initiatives the risks associated to lending directly to households is likely becoming more uncertain.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.