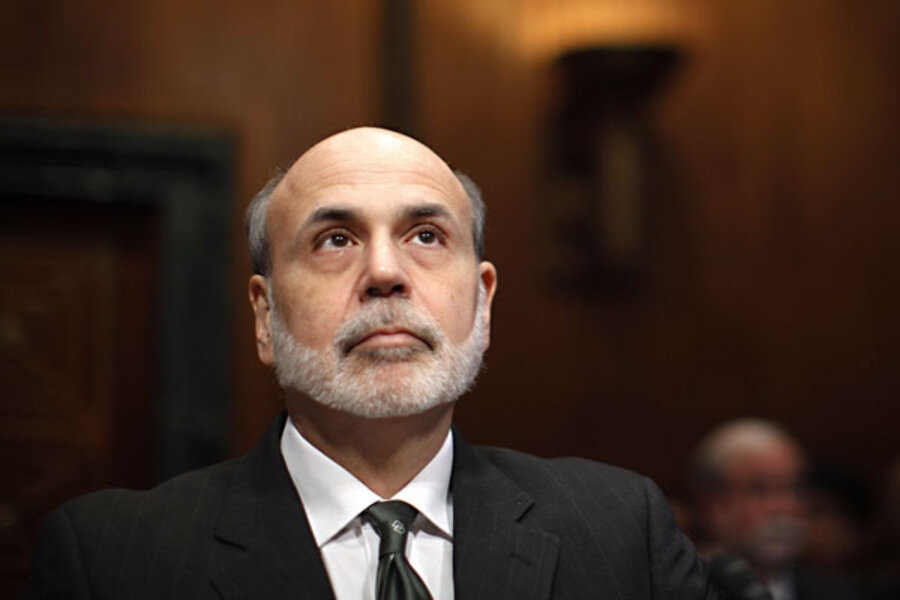

Ben Bernanke shows his mettle, again

Loading...

I thought Federal Reserve chair Ben Bernanke once again showed some mettle in these remarks to the Senate Budget Committee on the economic outlook. He’s not at all swept up in optimism about recent improvements—he’s particularly on point regarding continued weaknesses in the job market—and he clearly cites all the reasons to keep pressing on monetary stimulus.

One note on taxes, because this came up on Larry Kudlow’s show Tuesday night. Ben correctly warned, based on the same type of analysis I show here, that the fiscal drag from the tax increases under current law—full Bush sunset, AMT hits a lot more people—would be too much for a still weak economy to absorb in 2013.

As the WaPo put it:

…the Fed chief continued to stress that a sharp, immediate push to reduce the deficit could harm the recovery in the upcoming months. In January 2013, he pointed out, the George W. Bush tax cuts will expire, and the major spending cuts triggered by the Budget Control Act will take effect, absent any further action by Congress. As a result, “there will be sharp change in fiscal stance of the federal government. Without compensating action, it would indeed slow the recovery,” Bernanke told the committee members.

I think Bernanke knows he’s operating from a playbook where the Fed is the only game in town in terms of stimulus. The economy still needs a boost—he called the pace of recovery “frustratingly slow”—but he knows Congress will be MIA for the indefinite future, and that means little new fiscal stimulus will be forthcoming.

That doesn’t mean, as my buddy Larry K suggested, that Ben is some kind of supply-sider who believes any tax increase will tank the economy. He’s got perfectly legit street cred on the need for balanced deficit reduction, and he understands that new revenues will have to be part of that deal.

The issue here is, of course, timing, and the 2.5% of GDP fiscal drag in 2013 (Zandi’s number) embedded in current law is way too much for what will still be a recovering economy. The highend cuts should definitely expire on schedule, but the rest should be phased out as things improve.

So, as I’ve said before, nobody’s perfect, but Bernanke is doing great work. I like the aggressiveness, the creativity (the use of their balance sheet while their main tool–the benchmark interest rate–is bound by zero), the transparency and signalling, the clear-eyed assessment of the still-weak economy…I even like the neatly-trimmed beard.

All’s I’m saying Ben, is that if Perry comes after you, I’ve got your back.