9-9-9 will get you...eventually

Loading...

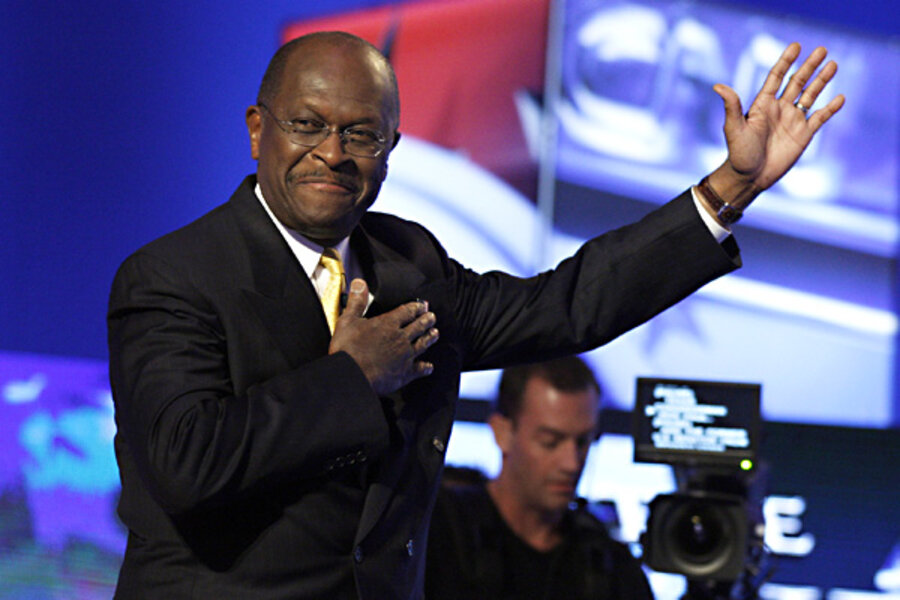

Re: Herm Cain’s 9-9-9 tax plan, a number of commenters (very reasonably) question why you would assign the full 9% of the sales tax to people who don’t consume all of their income.

Perhaps the easiest answer is to just think of the sales taxes you face today, if you live in a city or state that has one. If it’s X%, you probably don’t think of it as <X just because you don’t spend every penny. You correctly think of it as X, because eventually, you (or your progeny) will spend what you’re not spending today, and at that point you’ll face the tax.

If you don’t consume your income today, you will tomorrow, and it amounts to the same thing in “present value” terms (“present value” is just the value of future income streams in today’s dollars).

Ed Kleinbard explains it here, but I grant you it’s not exactly intuitive:

Imagine, for example, that an employee has $500…available to spend on consumption goods. When she spends that, she will incur a sales tax bill on her purchases. If the sales tax rate is 9 percent…she will incur a sales tax bill of $45…

But what if she doesn’t spend all the money today?

One way of seeing what happens in the deferred consumption case is to imagine that the employee sets aside $45 today into a little fund to pay her eventual sales tax bills attributable to spending $500. If the employee spends all her available money ($455) on consumption goods tomorrow, the money just immediately goes out of the little set-aside fund. If by contrast the employee defers consumption for a few years, then her budget for consumption (her $455 of cash, net of her mental sales tax set-aside fund) goes up by the time value of money [meaning she invests it, for example, so it grows--JB]…, but so does her $45 set-aside fund. When she does consume she will consume more in absolute terms, but the same in original present value terms…

The net consequence is that the sales tax is equivalent to another 9 percent payroll tax…