Housing market: Prevention over correction

Loading...

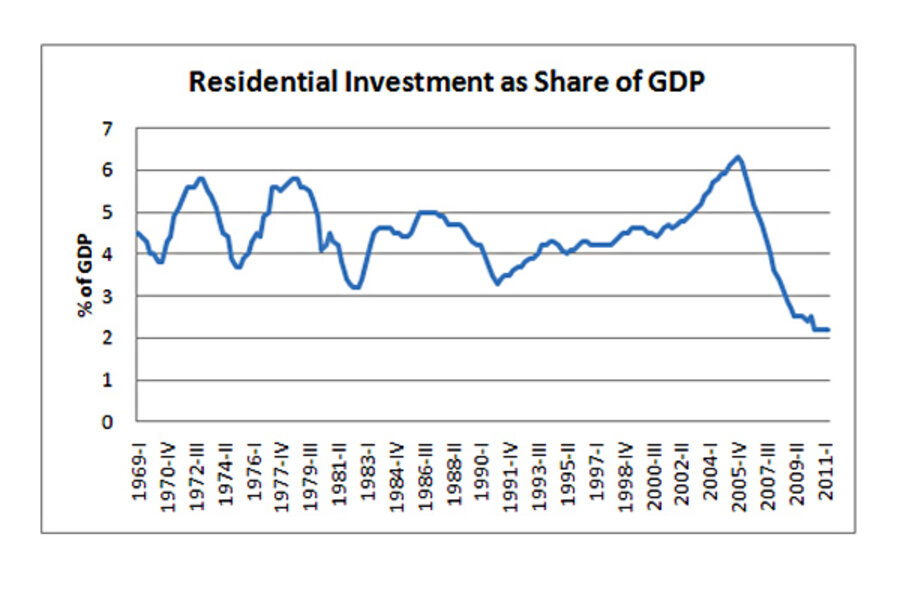

The housing market is still bumping along the bottom. As the above figure shows, it’s not providing any support to the larger economy, as residential investment (basically, home buying) as a share of the economy is stuck at an historical low.

Though policy measures to fix the problem have taken a lot of heat, some of it justified, this is much more a failure of preventive policy than of corrective policy.

The economically lethal combination of financial engineering, drowsy regulators, lousy underwriting, all amped up on fantasies about self-correcting markets, led to a lot of people got home loans they couldn’t realistically service. Once the bubble burst and home prices stopped rising, this reality was only further amplified by the the worst downturn in generations.

Add in some unique aspects of housing finance— the ability of banks holding non-performing loans to convince themselves that such loans will come back to life (“extend and pretend”), conflicting incentives by loan servicers, the banks screwing up the foreclosure process with robo-signing—and this was always going to be a slow, painful “correction.”

Of course, corrective policy could have done more—the fact that the locus of decision in most corrective policies lie with the banks/lenders themselves has always been a shortcoming. We needed more policies, like cramdown of loans on primary residences, a policy that would have allowed homeowners (borrowers) to take action even while creditors dragged their feet.

There’s still good stuff we should do to help modify loans, reduce principal, and cut down the supply overhang—on that last point, I like this idea to move Fan and Fred’s foreclosed properties from the residential to the rental market. Here’s a useful article that takes a look at these and other ideas worth pursuing.

But at the end of the day, the main lesson from all this is that when it comes to financial or housing markets, preventive policy is better than corrective policy. The Greenspan Fed got this exactly wrong, arguing that the Fed can neither spot nor stop bubbles.

Re spotting, that’s demonstrably untrue: foresightful members of the regulatory community and the central bank themselves were sounding warnings early on: Sheila Bair of the FDIC was working with Ned Gramlich of the Fed on this stuff starting in the early 2000s.

Re stopping, there’s little question in my mind that had we listened to folks like those just mentioned instead of hanging on every word of the maestro himself, regulators could have reined in lending practices that were clearly unsustainable, like negative amortizations, interest-only, and other greatest hits from the subprime slime.

Our best move would have been not to have a housing bubble. Our next best move will be to not have another one.