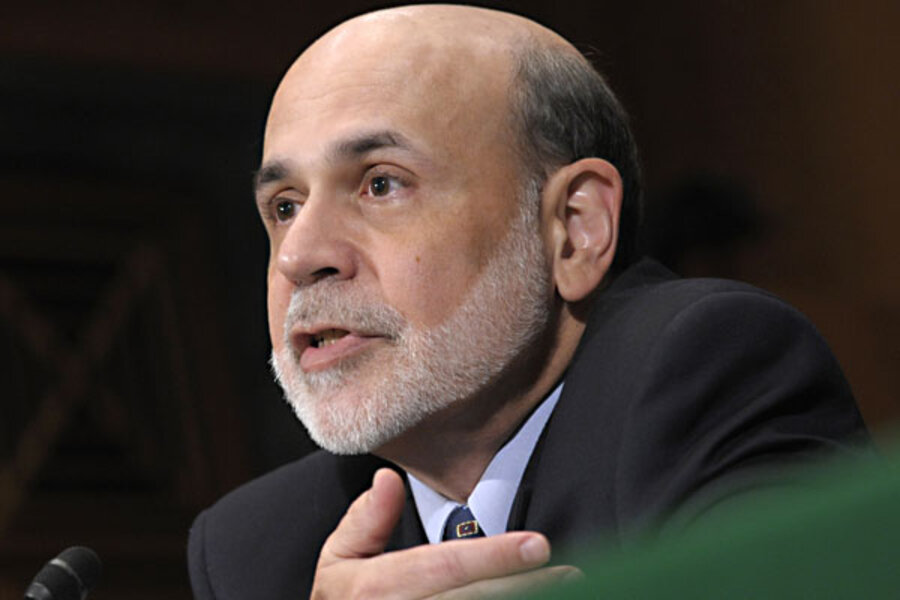

Ben Bernanke announces more monetary stimulus

Loading...

I did not expect Fed chief Ben Bernanke to announce more monetary stimulus today and I wasn’t disappointed…I mean, I was, but…you know what I mean. (The stock market was hoping for more and tanked on the news, but it’s climbing back.)

We could use more help from the Fed than Ben offered, though I’m probably less convinced than others of my ilk that another round of easing—printing money to buy longer term bonds—would have helped much. Interest rates are already low and firms are sitting on phat cash reserves. What’s missing is more demand, and that takes me to his points on fiscal policy.

What I was hoping to hear, and kinda got, was an endorsement of significantly more fiscal stimulus in the form of targeted jobs programs. Here’s Big Ben:

Normally, monetary or fiscal policies aimed primarily at promoting a faster pace of economic recovery in the near term would not be expected to significantly affect the longer-term performance of the economy. However, current circumstances may be an exception to that standard view–the exception to which I alluded earlier. Our economy is suffering today from an extraordinarily high level of long-term unemployment, with nearly half of the unemployed having been out of work for more than six months. Under these unusual circumstances, policies that promote a stronger recovery in the near term may serve longer-term objectives as well. In the short term, putting people back to work reduces the hardships inflicted by difficult economic times and helps ensure that our economy is producing at its full potential rather than leaving productive resources fallow. In the longer term, minimizing the duration of unemployment supports a healthy economy by avoiding some of the erosion of skills and loss of attachment to the labor force that is often associated with long-term unemployment.

Boom!—as strong an endorsement of a robust, short-term jobs plan as you’ll get from a Fed chief. This should inspire the President’s team to hit pretty hard in the Sept jobs speech.

One final point. While I’m not sure more Fed easing would help much right now, I think that if underlying demand were stronger, I could help a lot. In other words, fiscal and monetary stimuli are partners right, but there’s a sequencing: first, fiscal needs to wake up the demand side of the economy, then easing could help amplify the impact of that demand.

Unfortunately, if the Fed is reluctant to ease now, they’d be even more so if some growth actually showed up on the scene.