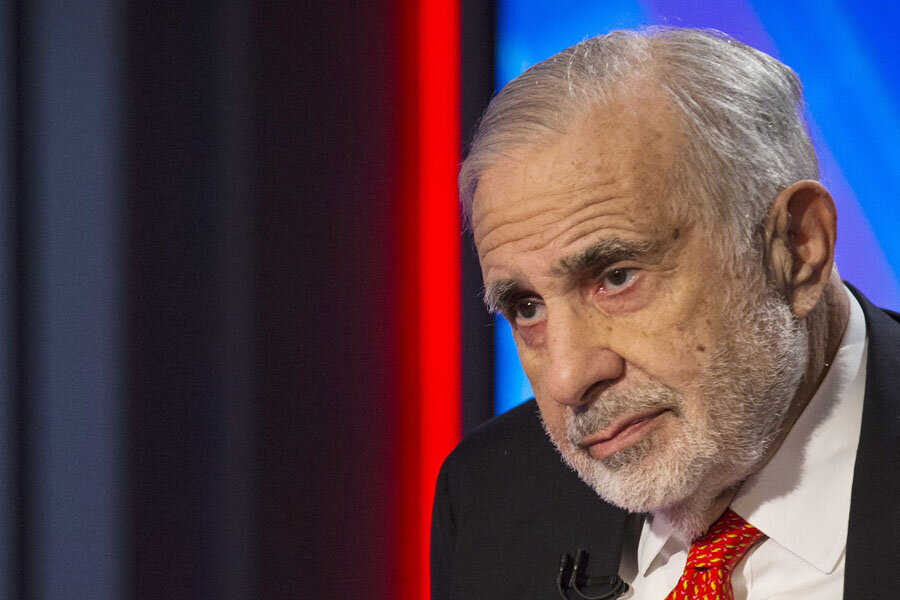

Apple stock (AAPL) selling at half its value, Carl Icahn says

Loading...

Activist investor Carl Icahn said he would like to see an Apple stock buyback of as much as $100 billion, but that he would never engage in a proxy fight against the company.

Speaking with CNBC's "Fast Money: Halftime Report," Icahn said "there will never be a proxy fight between Apple and me. Tim Cook has performed admirably, the board has acted responsibly. And if they don't do it, hey, I'm still their buddy."

Icahn said that he believes Apple is a strong company that rivals cannot hope to compete against, comparing the company to IBM "back in the old days."

Icahn chose to share the letter publicly instead of confidentially with CEO Tim Cook because this is the best way to "get to the shareholders," he said. The more shareholders that join in this endeavor, the more likely the buyback will be done, he explained.

Unlike the letter to Apple Icahn published last year, this letter does not suggest a specific buyback amount.

Icahn said the whole process has been very respectful and amicable. He called Tim Cook before the letter was published to give him a heads up. During the call, Icahn said Tim Cook agreed the company was undervalued.

Turning to the broad economy, Icahn said a market correction is "definitely coming," and that he is placing a lot of hedges including shorting the S&P.

"I've been quite concerned for the last year or so. But we have a hell of a lot of stock in our portfolio so you sort of root for the upside," Icahn said.

"You can't keep the economy up just from the Fed. The Fed alone can't do it," he said, adding that "one of our problems in the country" is that too many corporate leaders are "mediocre."

Thursday morning, Icahn released a letter to Apple, asking the company to make a tender offer for its shares. He said he believes the tech giant is undervalued—his models put Apple at $203 per share, more than double the current $100 price.

Icahn, who owns about 53 million shares in the company, wrote in the letter that "the excess liquidity the company continues to hold on its balance sheet affords the company an amazing opportunity to take further advantage of this valuation disconnect by accelerating share repurchases."