New economic outlook report is overly optimistic

Loading...

The Congressional Budget Office’s new budget and economic outlook is out, and as usual, it really doesn’t seem all that bad when you look at their “baseline” numbers. (Deficits as a share of GDP over the next ten years are still at economically sustainable–less than the growth rate of the economy–levels.) Oh, except that the CBO baseline is (by law) a projection of current-law policies, which assume a lot of very optimistic (some might say “delusional”) things about Congress’s proclivity toward fiscally responsible behavior.

You see, in current law there are lots of costly policies that expire after a year or two…or nine, or two–as in the 2001 Bush tax cuts which were first scheduled to expire at the end of 2010 and now again are scheduled to expire at the end of 2012. Expiring tax cuts have been the most fashionable way to deficit spend in this town ever since.

In their budget outlook, CBO assumes any tax cuts scheduled to expire actually expire. That could mean CBO’s assuming they will actually expire, or it could mean (more realistically but still very optimistically) that if Congress and the president extend the tax cuts in the future, that they will fully offset their cost, by cutting spending or raising other taxes–a novel concept known as “pay as you go.” Once upon a time, Congress followed strict pay as you go rules–on both tax cuts and mandatory spending–and they complied with discretionary spending caps, too. By the way, that was the last time we were actually running budget surpluses, at the end of the Clinton Administration.

Now Congress prefers to make policies look less costly by making them “temporary,” with official expiration dates that CBO has to officially score as being less costly because they (are supposed to) expire. But a more realistic “business as usual” projection would assume that these previously-always-extended-and-deficit-financed tax cuts will continue to be extended and deficit financed.

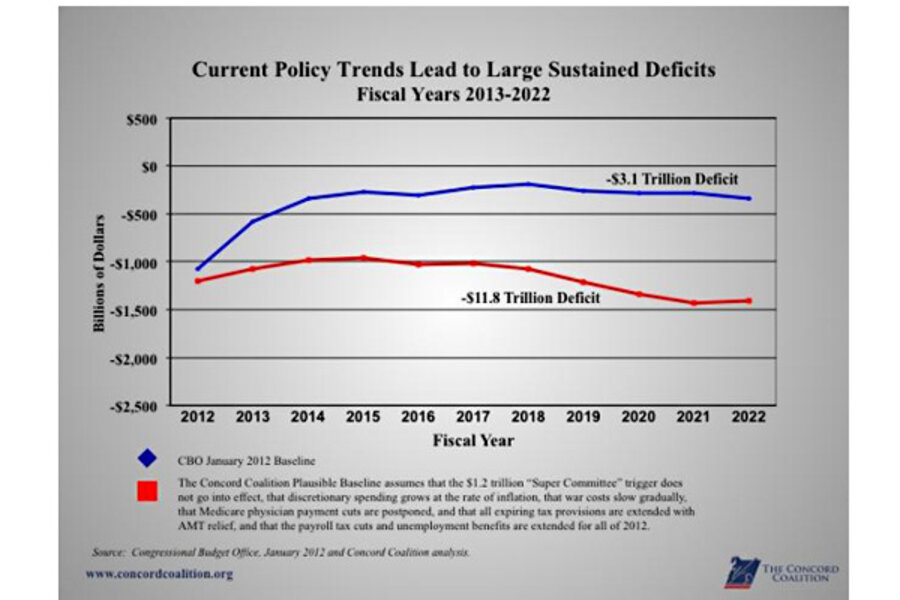

Enter the Concord Coalition’s “plausible baseline” (illustrated above), which we’ve been calculating for many years now, and which has told (really) the same old story for many years now, just the numbers keep getting worse because the fraction of the tax cuts that are on unofficial time (past expiration dates) vs. official time keeps growing. Every year it seems that the multiple of the deficits under Concord’s plausible baseline relative to those under the CBO official baseline keeps swelling. Last year I remember saying that the plausible baseline’s deficits were triple the CBO deficits. This year it’s closer to quadruple.

Most of the $8.7 trillion ten-year difference, $6.5 trillion, is due to tax policy. The (expiring) Bush tax cuts and associated Alternative Minimum Tax relief alone account for over $4.5 trillion of the difference, even without associated interest costs. (With interest, the deficit-financed extension of the Bush tax cuts and AMT relief would add almost $5.4 trillion to the ten-year deficit numbers.)

Some of you might remember what the so-called “super committee” was trying to do: they were trying to “go big” and find, hmmm, maybe $4 trillion worth of deficit reduction relative to the “business as usual” or “policy-extended” baseline. The “go big” solution is that which most economists feel is necessary to get deficits back down to economically-sustainable levels… like those very ones that are shown in this new CBO report. So that would have been a piece of cake for the super committee–or anyone else in Congress who might want to be a fiscal superhero–if they just looked at the CBO baseline and figured out how to stick to it. (Hint: PAYGO.)

So there’s not much new here. The CBO report still provides us with a fiscal roadmap with one very clear route highlighted as the fastest one to the land of sustainability. All the road signs point clearly to that one route, but all the policymakers keep missing that turnoff ramp, over and over again. And none of them really want to talk about it.