Surprisingly, Wall Street doesn’t seem to care who gets elected. So far, at least.

Loading...

Amid the alarm bells and hand-wringing over this year’s presidential election, there’s one prominent island of calm: Wall Street.

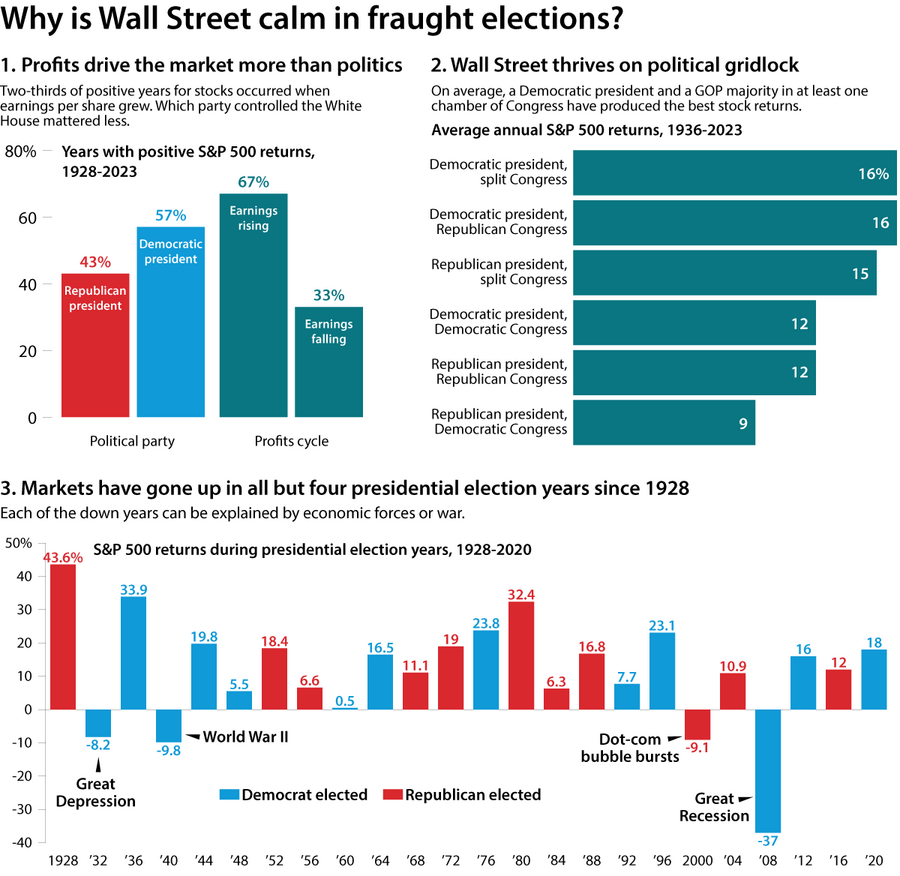

The stock market has remained buoyant even in a race between two starkly different candidates and with no clear sense of which one will win. And a good many are predicting stocks will be higher still at year-end. Sure, Vice President Kamala Harris might raise taxes and former President Donald Trump could widen the deficit. But history suggests that elections don’t matter all that much to the stock market, especially if they result in split party control of Congress and the White House.

With Election Day less than a week away, the S&P 500 is up by double digits for the year.

Why We Wrote This

Amid all the turbulence surrounding the Harris-Trump presidential race, Wall Street isn’t panicking. The stock market is up, in part because politics don’t drive the whole economy. Still, the Trump tariff proposals draw warnings.

There’s one fly in this ointment of market serenity: Mr. Trump’s tariff proposals. A radical departure from decades of bipartisan American policy, they threaten to raise prices for consumers, stoke inflation, and slow growth. Both sides of the political divide warn that tariffs could even spark a trade war with dire and unpredictable effects.

“This is a prescription for the mother of all stagflations,” Larry Summers, Treasury secretary during the Clinton administration, told Bloomberg TV back in June.

Mr. Trump’s “tariff agenda is an anti-growth wild card that poses considerable economic risk in a second term,” The Wall Street Journal’s editorial board intoned two weeks ago.

The issue is not so much that Wall Street doesn’t perceive the threat. Very few analysts believe Mr. Trump’s rhetoric that tariffs would boost growth. What’s hard to pin down is how far tariffs might reach and how much damage they might do.

Is he serious about imposing tariffs, even on the imports of U.S. allies? What happens if they retaliate? Would Mr. Trump raise trade duties even more, sparking a tit-for-tat trade war that, history suggests, would end badly for everyone?

“No one wins trade wars,” says Warren Maruyama, a senior counsel at Hogan Lovells and former general counsel of the Office of the U.S. Trade Representative under President George W. Bush. “They tend to be very, very ugly. And people get hurt.”

Stocks have risen in most presidential election years

Some sectors of Wall Street have concerns, especially bond traders, who worry the higher inflation expected under Mr. Trump would force hikes in interest rates. Rate rises would lower bond values. But optimism still reigns generally, because of other considerations. One is the hope that other bits of Mr. Trump’s agenda, particularly deregulation and lower taxes, would offset any negative consequences from tariffs.

Another is market history. Stocks have risen in all but four presidential election years since 1928, points out First Trust Portfolios. And in those four elections – 1932 (the Great Depression), 1940 (World War II), 2000 (the bursting of the dot-com bubble), and 2008 (the global financial crisis) – economics and war weighed much more on investor sentiment than the candidates’ economic policies.

“U.S. corporations are global, U.S. policy is just a subset of what impacts corporate America ... and even major policy changes like corporate tax rates and tariffs tend to be competed away over time,” concluded Bank of America Securities in a July analysis of election effects on markets. This year, corporate earnings look to accelerate and Wall Street, with its typical stock-specific focus, has pushed markets to new records in recent months.

Others hope that Mr. Trump would move slowly to implement his trade policy – or that Congress or the courts would block such moves. But one trading firm reports that Robert Lighthizer, Mr. Trump’s U.S. trade representative and close adviser on trade, is telling money managers that a second Trump administration would move quickly to implement his sweeping tariff plans. As for Congress or the courts stepping in, the former has over the years given presidents broad authority to act unilaterally in emergency situations, and the latter has given presidents wide latitude in foreign affairs.

“The courts have tended to give the president a fair amount of running room when it comes to actions that involve national security, international economics, or international trade policy,” says Mr. Maruyama, the former general counsel of the Office of the U.S. Trade Representative.

Would tariffs spark a deal, or a trade war?

Another hope is that Mr. Trump’s professed love of tariffs – “the world’s most beautiful word,” he said in Chicago two weeks ago – is merely a negotiating tactic. Supporters point out that he instituted tariffs on steel and aluminum in 2018 and threatened duties on car imports in order to wring concessions from Canada and Mexico in successfully negotiating the USMCA trade pact. He now may be doing the same with Europe in part to create a united front against Russian aggression and Chinese imports, writes Nadia Schadlow, senior fellow at the conservative Hudson Institute and deputy national security adviser for strategy in the Trump administration.

If Europe can stop viewing him as an enemy, she says, “A pro-growth, pro-freedom partnership is possible.”

But that will be hard to do when Mr. Trump is threatening across-the-board 10% to 20% tariffs on all imports, including those from Europe. The more likely scenario is that other nations would institute tariffs of their own against U.S. imports.

“If he gets exactly what he says he wants, you’re going to see retaliation,” says Mark Zandi, chief economist of Moody’s Analytics.

How bad it gets depends on how far the retaliation goes. The Tax Foundation estimates the net effect of Mr. Trump’s tariffs would drag down the long-term growth of U.S. gross domestic product by 1.3% and create 1 million fewer jobs than the status quo. If foreign nations retaliated, GDP would slow another 0.4% with an additional 362,000 jobs not created. If the former president upped the ante with more across-the-board tariffs, it’s difficult to model how much more damage there would be.

This uncertainty poses possibly the biggest problem. It causes consumers to rein in spending and businesses to cut back investments, slowing growth.

“Any short-term benefits gained by driving a hard bargain in bilateral negotiations or in a given industry would be vastly outweighed by the macroeconomic costs of generating uncertainty,” writes Adam Posen, president of the Peterson Institute for International Economics, in Foreign Affairs magazine. “This is the fundamental flaw that shapes Trump’s agenda.”