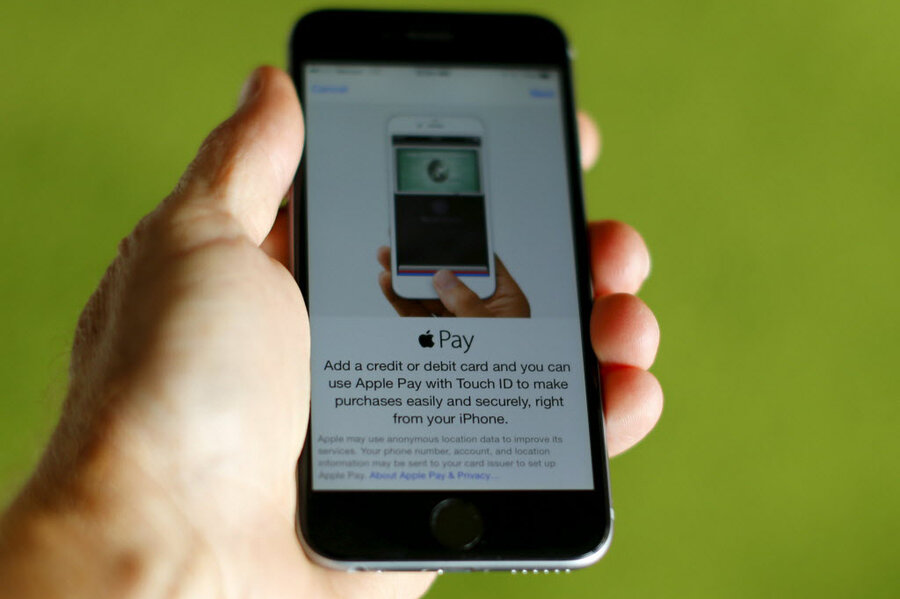

Apple Pay launches in Britain, but not everyone is on board

Loading...

Apple introduced its Apple Pay mobile payment system to Britain on Tuesday. Now, Apple customers in the United Kingdom will be able to use their iPhone 6, iPhone 6 Plus, or Apple Watch devices for purchases at more than 250,000 shops across Britain, according to the Telegraph.

The introduction of Apple Pay into the British consumer market comes almost a year after the payment system launched in the United States. While some have complained that the US's version is not easily accessible to consumers, many believe that the current British retail environment is well suited to Apple Pay.

"We actually think that the UK can be our leading market for Apple Pay, given the unique characteristics (of the market)," Jennifer Bailey, vice president of Apple Pay, told Reuters.

Part of this comes from the rise of recent tap-and-go payment methods. British banks, retailers, and consumers have been more attuned to the contactless payment method. The London Underground’s recent addition of contactless payment could be an indication of the UK market for Apple Pay.

Apple Pay will eventually be supported by all British banks, Reuters reports, though not all will be available right away.

HBSC reportedly was unable to meet the Apple Pay launch on Tuesday, and will instead support the mobile payment system later this month, according to the BBC.

Additionally, Barclays signed on to Apple Pay on Tuesday, confirming to customers that they would be able to use the service at some point in the future.

70 percent of all credit and debit cards can be used with Apple Pay, according to Ms. Bailey. Once Barclays finalizes its involvement with Apple, that number will top 82 percent.

However, some aren’t so certain that Apple Pay will be able to make a sizable impact in the payment market. For many, its popularity is attached to the company that makes it rather than the service itself.

“We have been surprised that so many banks have signed up to support Apple Pay,” Benjamin Ensor, an analyst at Forrester Research, tells Reuters. “It’s worth asking what Apple Pay brings that the banks can't do themselves.”

Ensor says, though Apple has been able to connect retailers and consumers, the rise of mobile payments shouldn’t be tied to smartphone companies.

“Are people crying out for a really different method of making payments? I think that’s not yet clear,” he says. “Consumers just want to buy stuff.”

This report contains material from Reuters.