Economy cools as government spending drops. Wrong time for budget cuts?

Loading...

The US economy lost some steam in this year's first quarter, posting an annual growth rate of just 1.8 percent – too slow to support a rapid recovery of jobs lost during the recession.

The downshift, reported Thursday by the Commerce Department, stemmed in good measure from declines in spending by government at the federal, state, and local levels. In all, changes in spending by government subtracted about 1 percentage point from GDP, partially offsetting larger gains in private-sector consumer spending.

And that's before any major efforts at reducing federal spending – proposed by both President Obama and congressional Republicans – kick in.

To some economists, that raises the question: Is the recovery still so fragile that an emphasis on reducing federal spending could hurt rather than help?

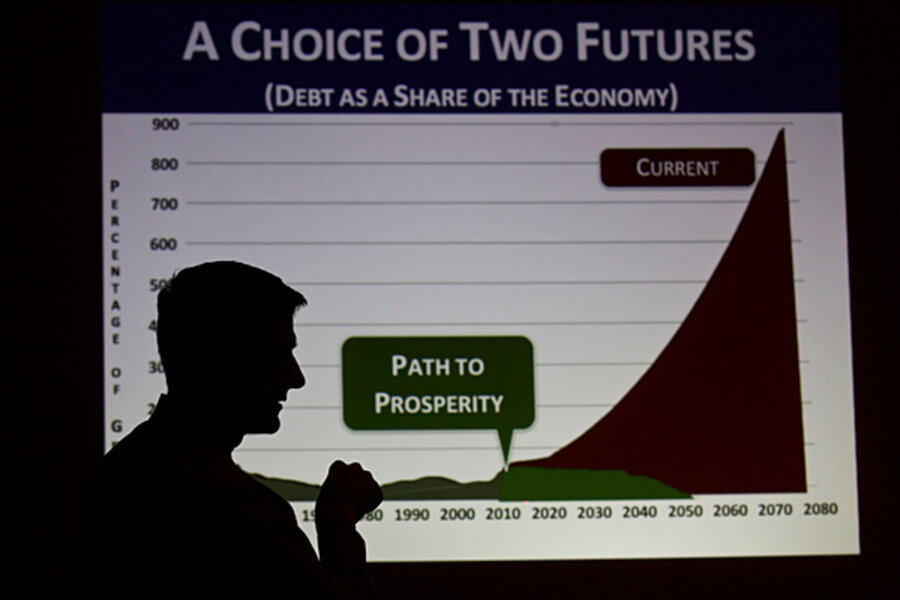

Some forecasters say that by next year, the economy should be on firmer footing than today, and better able to handle a pullback in government spending. Others, however, argue that a Republican proposal outlined recently by Rep. Paul Ryan of Wisconsin is the wrong idea at the wrong time.

One view: Wrong time for cuts

"The immediate impact of these cuts would be a significant loss of jobs in an economy already 11 million jobs short of reaching pre-recession unemployment rates," write Ethan Pollock and Andrew Fieldhouse, in a recent analysis for the liberal Economic Policy Institute.

By their reckoning, the proposed $196 billion reduction in nondefense discretionary spending, over the next two budget years, could cost the economy 900,000 jobs in 2012 and 1.3 million jobs in 2013.

They and other economists aren't suggesting that cuts in federal spending are, by themselves, bad for the economy. The problem is timing. Since many US consumers are still struggling with high debts or unemployment, the risk is that a cutback in federal spending (and borrowing) wouldn't be matched by a pickup in private-sector spending and borrowing.

"Expansionary fiscal policy is the most effective policy lever remaining to jump-start the economy," Mr. Pollock and Mr. Fieldhouse write. "Ryan’s cuts do exactly the opposite by draining economic demand in an already depressed economy."

Another view: economy can handle cuts

A countering view is that the economy has already begun to move on the path toward recovery, so it will be able to handle a decline in so-called fiscal stimulus from government.

Many economists, moreover, say it's imperative that the federal government take steps to put itself on sounder fiscal footing for the long term – and that such steps will help job growth by boosting investor confidence and keeping interest rates low.

"We need to start this effort for deficit reduction," says Diane Lim Rogers, an economist at the Concord Coalition, a nonpartisan group that backs fiscal reform. "It doesn't need to be counterproductive for the economy."

"Probably by this time next year our economy is going to be stronger than it is right now," she adds.

By her reckoning, federal stimulus will be declining even without the enactment of new spending cuts, because tax revenue will be increasing and spending on things like unemployment benefits will be falling. Private-sector activity can be expected "to start filling in as the government stimulus activity is reduced," Ms. Rogers says.

Augustine Faucher, an economist at the forecasting firm Moody's Analytics, takes a similar view on whether spending cuts might affect the economy.

"I'm less concerned about it in 2012 than I am concerned about it in 2011," he says. Even though federal cutbacks this year may be modest, he explains, state and local governments are struggling to close budget gaps – and can be expected to reduce spending as a result.

Mr. Faucher calls that a down-side risk for the economy, along with other negatives such as high gasoline prices.